Working capital: A summary of ratios by industry Case Studies

Introduction

In this case, the graphically working capital ratios are given for interpretation by understanding the calculation and its facts and figures. The most advanced and well-known companies are to be used in this case. The explanation of 04 major ratios of working capital is given in this solution. Those ratios are days inventory outstanding, days payable outstanding, days sales outstanding, and cash conversion cycle. In the explanation of these ratios, we deeply cover all the things mentioned in the case study.

Manufacturing Industry

Cash Conversion Cycle

The cash conversion cycle is the tactic that measures the effectiveness of the corporation. The CCC measures how rapidly the company can convert the present cash the company to generate more cash with the effectiveness of the corporation. The prime responsibility of the Cash Conversion Cycle is to convert the accounts payable and inventory into accounts receivable and sales and then convert the sales and account receivables into cash.

The four years trend of the manufacturing industry is analyzed which shows the industry has the highest Cash Conversion Cycle in 2010 as compared to the other three years' Cash Conversion Cycle. It means the manufacturing industry has the highest effectiveness in the year 2010 and the company converts the cash from investment in 94 days.

Operating Cycle

In the trend of 04 years of manufacturing industry, the operating cycle of the industry is good in 2010 as compare it with the previous and future years. In 2010 the industry received, sell and collect the inventory into cash in 153 days.

Retail Industry

Cash Conversion Cycle

After the manufacturing industry analysis, we analyze the four years trend of the retail industry is analyzed which shows the industry has the highest Cash Conversion Cycle in 2009 as compared to the other three years' Cash Conversion Cycle. The retail industry converts the cash from inventories in the 50 days. The retail industry is more effective as compared to the manufacturing industry in Cash Conversion Cycle.

Operating Cycle

In the trend of 04 years of the retail industry, the operating cycle of the industry is good in 2009 as compared it with the next years. In 2009 the retail industry received, sell and collect the inventory into cash in 89 days.

Ratio Analysis

In the Ratio analysis of all the given companies, we analyze the DIO, DSO, DPO, and Cash Conversion Cycle ratios through which we understand how much period the company takes to recover its inventory, sales, cash, and accounts payable and what is the relation of these working capital ratios with working capital.

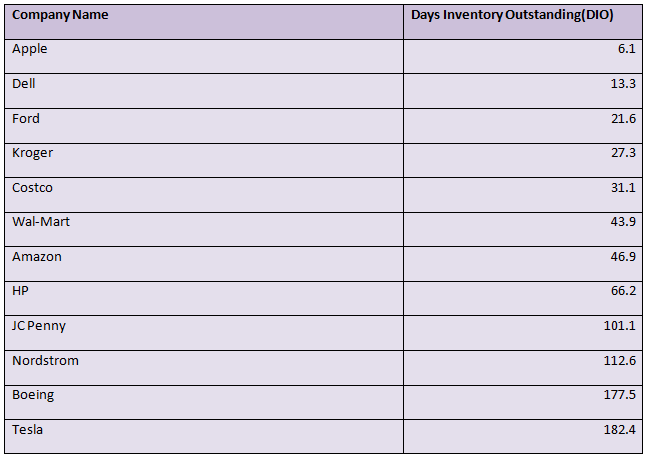

Days Inventory Outstanding (DIO) Ratio

Day’s inventory outstanding is the measure of an average number of days before selling inventory and how many days the company holds its inventory. The DIO and working capital have directly proportional to each other. The cash and inventory both are current assets that are why they share a strong relationship.

In the given table the DIO of all the companies is sorted. Apple has the lowest value of DIO of 6.1 days which means that apple holds the inventory 6 days before selling. It means the effectiveness of the corporation is high and the products are also in high demand. After the Apple corporation, the fewer days taken by the company is Dell which sold the products after the 13 days. The ford holds the inventory for 21.6 days whereas the Kroger and Costco hold the inventory before selling are 27.3 and 31.1 days respectively. Walmart takes 43.9 days whereas Amazon takes 46.9 days to sell the products in the marketplace. The HP holds the inventory for 66.2 days before selling. The highest days were taken by JC Penny, Nordstrom, Boeing, and Tesla. The Tesla Corporation holds the automobiles for about 182.4 days before the Selling. As the DIO is low the company can generate more revenue because the products are sold rapidly which is good for the company. The above companies which have a low DIO are because the company converts rapidly the inventories into sales which is beneficial for the corporation. And the companies which have higher DIO are because the company takes too much time to convert the inventory into sales.

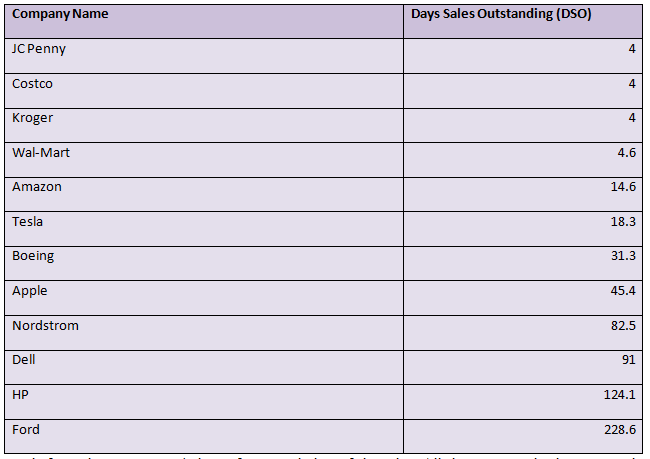

Days Sales Outstanding (DSO) Ratio

Days Sales Outstanding is the extent of the standard amount of days companies takes to collect the payment from the customers after the accomplishment of the sale. The sales and working capital have a positive relationship with each other as the number of sales increases the working capital of the company also increases.

Working capital A summary of ratios by industry Case Studies

case solution."}" data-sheets-userformat="{"2":14913,"3":{"1":0},"9":0,"12":0,"14":{"1":2,"2":3355443},"15":"Arial","16":10}">This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.