“William Wrigley Jr: Company Case” Solution

Introduction

The “William Wrigley Jr. Company” is based in the “United States”, which determinate a market in 1891(Shapovalov, 2010). “William Wrigley” is a confectionery manufacturing firm. This corporation is wholly owned by Mars. “Mars” stated in 2016 in the United States that the Wrigley Corporation will be combined with the Chocolate division of the company. This firm is the world’s leading manufacturer of chewing gums and a wide range of candy. William Wrigley is the company’s CEO & one of the company’s innovation centres is in Chicago. The corporation has production centres in 14 different countries. The firm offers its products in over 50 countries, including different sweets, chewing gums, & chocolate. This corporation produce huge amount of revenue from their products because consumers are interested in all the products of this corporate & through this situation corporate becomes a successful brand’s goodwill day by day.

Problem Statement

This is one of the couple’s scenarios used in a merger negotiating simulation. It’s usually used with Mars Incorporated, although it may also standalone. The Wrigley case is used by one-half of the class, while the Mars is used by the others. Wrigley & Mars are discussing a merger and are negotiating a deal. Wrigley's future cash flows are difficult to project because of macroeconomic assumptions, specifically estimating future sugar prices in an unpredictable environment, as well as assumptions regarding its value.

Situation Analysis

1) “William Wrigley Jr. Company” & “Mars” Amalgamation

Amalgamation of “William Wrigley Jr. Company” & “Mars” is a good idea because both corporates are a confectionery manufacturer like chocolates &candies, etc. In the year of 2008, both corporates amalgamation are complete. Wrigley corporate amalgamates into the Mars corporate & then Wrigley becomes a branch of Mars corporate. Both corporates head offices are in the same city name Chicago. After the amalgamation of both corporates, Mar's corporate name changed into Wrigley & Mars. Both corporates believes innovation makes the company’s culture more strong and vision are also same to provide the consumers high-quality and satisfactory product, so this amalgamation is an excellent idea for both companies.

2) Both Corporates Strengths for Negotiation:

“High Quality Innovative Product”

- Both corporates goodwill are high because both companies are providing to customer high-quality services and products.

- After the amalgamation, both companies are more design and innovation in the confectionery product.

“Dependable Dealers”

- Both companies named “William Wrigley Jr. Company” & “Mars "dealers are trustable and dependable. It means that the dealers are to supply the “Raw Material Product” to the both companies on time and this attitude of dealers is to establish the strong distribution management.

“Demand-Oriented Price”

Both company’s product prices are very low and demanding, so all consumers of these company are avail this opportunity and this is the reason behind “High Sales”.

“Quick Delivery System”

Both companies are well known for their “speedy delivery”. Similarly, they guarantee delivery within thirty minutes, & if the customer doesn’t receive it within that time, so the company provide to the consumer “complimentary package product” As the result, they are always on time.

“Production of Internal Recipe”

Using no vendor, the company produces its own recipe. That is why they’re both companies’ recipe differs from that of its “competitors” and many other fast-food joints. They generate high-quality products by combining vertical & horizontal processes. As a result, both companies have made it a secret active product recipe.

“Reputational Strength”

Every client of both companies recognized it through its quality services, resulting in a high brand name equity. Both companies focus on producing high-quality items and delivering them within thirty minutes, resulting in a strong brand image. Therefore, the company has many repeat customers.

“Employees with a High Level of Skill”

Both companies have ensured that their staff receive training and development in order to improve their skills. Certainly, the business has maintained the staff member’s motivation to work because of its non-monetary “worker of the month” and monetary rewards “perks and increments”. The knowledge programmes assist the company in increasing its efficiencies and capabilities. (Show in the Appendix)

3) Both Companies are Equal Revenue Size

This amalgamation of two companies named “William Wrigley Jr. Company” & “Mars” becomes equal because both companies are same revenue size and same product line. It means that both are “confectionery manufacturer”. Before the amalgamation, in 2007 both two companies are same revenue size. In 2007, the revenue size of both companies is about “five billion four hundred million” dollars. And this revenue size criteria shows that both companies’ amalgamation is equal.

Valuation of Wrigley Using a DCF Method

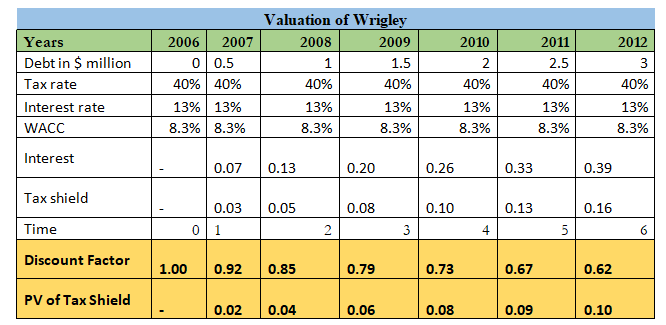

We go through a valuation procedure to analyze the merger, in which we assess all the aspects that have a favorable or negative impact on the company. The tax shield and discounted factor of all years are calculated by using“8.3%” weighted average cost of capital. In the merger’s year, Mars owes $1 million. The tax shield is utilized to boost the company’s value as the tax shield grows. This means that the corporation paid lower taxes, and resulting in a higher profit.

Conclusion

Finally, both companies have showed that they have a competitive advantage and that their organization works well. The company has overcome its previous stages of decline. Now, both companies “William Wrigley Jr. Company” & “Mars” have met the wants and needs of their customers by providing them with far healthier options. Both companies are global corporation with a diverse set of capabilities. They have experienced many hurdles in the international market, but their profits and properties remain high. Other food industries have found that planning marketing strategies has become impossible.

Both companies have always kept their long-term pledges. They are still attempting to manage their positions in relation to direct competitors. Because of the significant brand equity that both companies have developed over the years by providing “high-quality products” and “exceptional service”, both companies are always pushed to stay strong and maintain a positive market position and track record. The Mars firm’s head of amalgamation is seeking for a company to amalgamate with so that they may diversify their markets and expand their product offerings.

“Mars and the William Wrigley Company” are amalgamated. The talks between the two parties begin in 2005 and end in 2008, when they decide to unite. For the deal, “Mars” paid “Wrigley” two hundred sixty-three billion. Wrigley was an excellent choice for Mars because it operates in about 50 countries around the world. Both companies 'amalgamation is of equal value, with several benefits and future possibilities. In the United States, the merging of the two corporations reduces competition in the chocolate and candy industry. Synergy increases the worth of both companies. Finally, we conclude that the amalgamation will benefit for both companies......................

“William Wrigley Jr Company Case” Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.