Ventramex and the Mexican Peso Crisis Case Study Solution

Fomet informed Ventramex that Fomet needed to raise its price on cold head pins by 150%. What should Dave Salidas do in light of Fomet’s demand (counter-offer on price, seek alternative supplier, etc.)?

Fomet had informed the Ventramex management that it intended to increase the price of cold head pins by 150%. All the suppliers had involuntary price increases and none of them had any valid reasons for the increase in the price of the goods supplied to Ventramex. The suppliers were increasing their prices erratically without any logic and their price’s increase percentages were much higher than the inflation rate or the exchange rate changes as we can see from the examples of Fomet and Metcast, the two key suppliers of Ventramex.

The owner of Fomet had informed Dave Salidas that the anticipated 150% increase in the price of the cold head pins was due to the anticipated increase in the inflation and the Peso devaluation. Dave was not at all surprised by the actions of Fomet as the relationship of Fomet was not a good one with Ventramex. At one point, Fomet had informed the management of Ventramex that they were dropping the company as their customer but later on they had changed their mind.

With regard to the current situation there are three alternatives available to Dave Salidas to negotiate the supply of the cold head pins and these are briefly defined as follows:

Counter Offer on Price

The first option is to recommend a counter offer for the price increase to the management of Fomet. However, it is less likely that they would accept any other offer for price increase as they have set their minimum limit at 150%. They had offered Fomet a 70% price increase based on the increase in the domestic material content of the selling price by the inflation rate and the imported material content of the selling price by the full exchange rate from 3.11 to 7.5. However, Fomet had refused the offer and insisted on 150% price increase only.

Seek Alternative Supplier

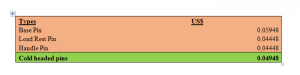

The second option for Dave is to seek for alternative supplier but again given the current situation in the market and the process of sourcing the new supplier was highly problematic. Most of the local suppliers had been forced into bankruptcy as a result of Peso devaluation. Many suppliers faced the problem of steel prices and the industry had become non-competitive and inefficient. One of the key alternative supplier was Sotek that was willing to supply the cold headed pins for an average price of $ 0.04948 per pin as follows

The owner of Sotek, Jose Gomez was prepared to sell the cold headed pins to Ventramex that it required for selling it to CANMEXUS.

Accept the price Increase

Finally, given the current situation of the market, the steel prices, Peso devaluation and the increases in the inflation rate, Dave can accept the 150% increase in prices by Fomet and continue Fomet as its supplier.

Recommendation

Based on the market situation and the position of Dave, it would be more beneficial for Dave to close the relationship with Fomet and begin a new relationship with Sotek only after performing a critical review of all the areas for Sotek as specified in the case. Dave is therefore, recommended to go ahead with the second option and seek alternative supplier.

Question B

CANMEXUS presented Ventramex with its “Peso Recovery Opportunity” program for adjusting the U.S.-dollar price CANMEXUS would pay Ventramex for its products in light of the Peso crisis. What modifications to this program, if any, should Dave Salidas recommend that Ventramex ask of CANMEXUS?

Ventramex and the Mexican Peso Crisis Harvard Case Solution & Analysis

There are a number of things that Dave should recommend to modify within the “Peso Recovery Opportunity” program. These are as follows:

- First, Dave should recommend CANMEXUS to state the source of all the numbers such as the exchange rate of 6 Pesos to each US dollar and all the other factors.

- Dave should recommend a one-time adjustment based on this “Peso Recovery Opportunity” program and not any other adjustments should be made in the future.

- Dave should ask CANMEXUS about the rationale and the basis on which the price reduction opportunity table has been prepared. Dave should recommend a clear basis for the computation of the price reduction based on the average exchange rate and the inflation rate increases. The computation of this table should be clear to Dave.

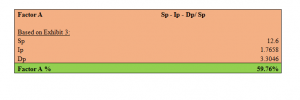

- Finally, the most important thing is that CANMEXUS had considered the Factor A for Ventramex Jacks to be 45% that it would sell to CANMEXUS. However, the basis is not clear about how CANMEXUS has arrived to this percentage. Based on the Factor A formula as specified in exhibit 4 and the information given in exhibit 3, the Factor A for Ventramex is approximately 60% as calculated in the excel spreadsheet and shown below:

-

Therefore, if the December 1994 average exchange rate was 6.2 and inflation rate was 45%, then Ventramex should expect an 11.4% decrease in the dollar price that would be paid by CANMEXUS. All these recommendations for modifications to the Peso Recovery Opportunity” program should be made by Dave to CANMEXUS.

This is just a sample partial work. Please place the order on the website to get your own originally done case solution.