Valuing Leidos and Lockheed Martin Case Solution

Question:1)i)

Porter’s five forces Analysis

Bargaining Power of Buyers

- Establishing a large customer base will benefit the company in two ways: it will allow the company to make more sales and will reduce the bargaining power of buyers.

- By developing new clients very frequently, as the clients often look for discounts and exceptional offers on new products. So, if the company Leidos Inc. keeps on presenting the new items then the buyers' bargaining power will decrease.

- The new product by Leidos Inc. will cause less customer defection in comparison to other competitors’ products.

Bargaining Power of Suppliers

- Due to the increase of various vendors in the supply chain; the bargaining power of suppliers will be increased.

- In developing the new product design by using different materials, the company can shift to another vendor for raw material, in case of having a high price.

- Creates dedicated suppliers who rely on the organization’s livelihood. Leido Inc. should learn from Nike and Wal-Mart, as they have created third-part producers on which the whole business is dependent. As a result of which, these third-party producers have less bargaining power.

Threats of New Entrants

- Leidos Holding Company operates in an industry where the economies of scale is difficult to achieve. This can be cost-effective for those who produce large capacities, but it also makes costlier production for the newcomers. Economies of scale can make the threat weaker for new entrants. So, the economies of scale can be achieved through fixed cost per unit.

- In this industry, there is strong product differentiation. Customers also prefer those products which are different, and this makes the new entrant forces weaker in the industry. So this threat can be tackled through developing innovative products and having a new customer base who would purchase those products.

- The requirement for capital is high in this industry. Therefore, it is difficult for new entrants to enter an industry where the expenditure is high. Due to research and development costs; the capital expenditure is high in this industry. Because of this factor, the threat of the new entrant's force is weaker.

Threat from Substitute Services or Products

- There is a minimal presence of substitutes in the industry where the Leido Holdings Company operates. The substitutes that are availablein the industry, operate at low profits and costs, which means that there isn’t any ceiling on maximum profit for any firm which operates in the industry. So, the threat of substitute force is very low in this industry.

- Leidos Inc. and Martin Lockheed sell their products at a very low price, and the substitutes that are present in the industry, are selling the product at an expensive rate. Hence concluded that the buyers are not likely to shift to other substitute products and there’s a weaker force of threat from the substitute.

Rivalry among the Existing Firms

- There are very few competitors in the industry which have a larger market share, and they are active in the competition, to gain position in the industry. So, there is a weaker force for rivalry.

- Every firm existing in this industry, has diverse strategies, and they are unique in their own rights, which creates a strong force for rivalry.

- The barrier of entry is high due to the high investment cost required. The Government regulation and laws are high in this industry, due to which, the firm is reluctant to leave its operations. This creates a strong force in rivalry.

Question:1)ii)

SWOT Analysis

Strengths

- Leido Inc. and Martin Lockheed’s merger and acquisition has proved to be successful, as they have made a track record in integrating technology and an effective supply chain management.

- It has created a culture in which the dealers and distributors not only advertise or promote the product, but they do invest in the trainingthe salespeople on how to provide better services to the

- They have a strong brand portfolio, and this brand recognition can help them in investing in anew product category.

- Leido Inc. and Martin Lockheed can operate in the new market, and it can streamline its revenue market by reducing the risk ofthe economic cycle.

- They have strong and various vendors in the supply chain who provide reliable raw materials.

Weaknesses

- The companies have lost little share in the niche market as they don’t control the entrants of newcomers. It was unable to tackle the challenges posed by the new entrants.

- Leido Inc. and Martin Lockheed havea low profitability ratio, and their net contribution is also lower than other firms in the industry.

- In comparison to other competitors; Leido Inc. and Martin Lockheed cannot appropriately forecast the demand for the product, due to which the companies missed all the opportunities.

- Despite investing more in its research and development; the company was unable to develop the products uniquely, as there was a lack of innovation in its product development.

Opportunities

- As markets are growing day by day, Leido Inc. and Martin Lockheed should increase their competitiveness in the market, to compete with the others.

- Leido Inc. and Martin Lockheed should invest in the product segment which has free cash flows. This can create an opportunity for the new product categories.

- Leido Inc. and Martin Lockheed should demonstrate the opportunity in technological leadership and acquire a huge market share in a new category.

- Acquire a huge customer base through an online platform, the company has already invested in the online platform, but it needs to have a better understanding of the customers’ needs through conducting data analysis and market research.

Threats

- The intense competition in the market can threaten Leido Inc. and Martin Lockheed’s operations. It can affect the sales and profitability of the firms.

- Changing laws and regulations, such as liability, imposed to the market, can threaten Leido Inc. and Martin Lockheed.

- Currency fluctuation can cause lower purchasing power of consumer, and customers can shift their demands.

- The rising prices and pay in China can cause Leido Inc. and Martin Lockheed to have lower profitability.

- Environmental regulation can affect the new product categories and threaten the firm's stability.

Question:2

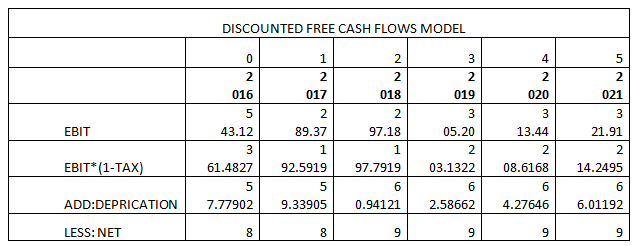

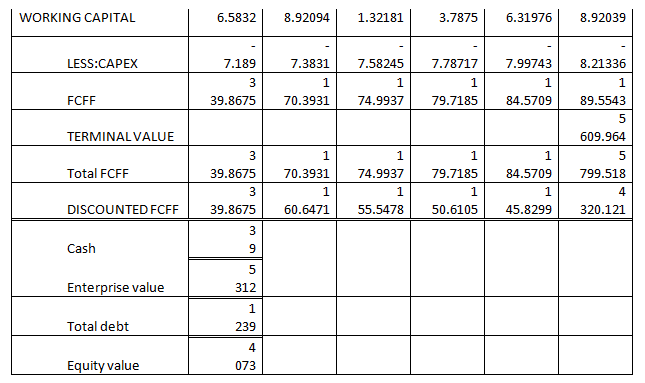

As Leidos has been valued at $4.6 billion; the valuation of company post-RMT is in range of $5.312 billion to $5.531 billion. Hence, the company is undervalued.(see appendix:1& 2).We have valued the company by using both market comparable and the discounted cash flows model. Both models have resulted in the enterprise value of above the value which was offered for the company’s division.

Question:3

Comparable Company Analysis (CCA) gives an accurate beta estimation. We use this when we compare the companies, and those comparable companies are same in size. Comparable beta gives a good estimation of the firm’s tendency to perform in the market.

Question:7

As the stock of Lockheed is trading in the stock market; it will be exchanged for the Motrin stock. Lockheed's share supply will increase, and the demand of Motrin stock, so at that point price of both will reach to the same price. The rick for the investor will be that the price of share will decrease to the same level........................

Appendices

Appendix:1

Appendix:2

Valuing Leidos and Lockheed Martin Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.