Teuer Furniture (A): Discounted Cash Flow Valuation: Case Analysis

Introduction

To Furniture is the modest size company in United States (Berg, 2018).In2003, the company start with the goal of providing house furnishing products to the customers with high quality. The furniture designs and productivity of Teuer was the competitive advantage for this company. The business starts in 2003 with one showroom in the city of Kansas. By facing economic fluctuations and environmental changes, business grow from single outlet to 29 outlets. Now the company has a strong financial background with positive working capital. The company has strong brand image, market shares and competitive advantage. The company has trustworthy customers, which are the main part of creating the brand positioning of the company in the industry of furniture.

Mission Statement

To Furniture has a complete focus on their mission statement. The company wants to do business in different cities through which the company increase the revenue and built an excellent reputation in the entire country.

Target Market

The company applies the strategy of Niche market in which company analyse the situation exterior the urban cities and tries to satisfy the customer’s needs and wants towards the furniture products. Company target based on high-level income, lifestyle and those individuals whose priority is of high quality in products.

Problem Statement

The investors want to sell shares to the company but the company never repurchases the shares from their investors now the problem for company it should company purchase the shares or not what’s the vice decision for Teuer Company?

Situational Analysis

In 2012, the investors of Teuer Furniture wants to sell their shares to the company but from the start-up of business, company never repurchase the shares from the company always used its additional cash for giving the payments to stockholders. For solving this problem, a financial Analyst from the team of Jerabek performs some financial statements from which the company can easily conclude the problem.

- Pro Forma Income Statement

- Pro Forma Balance Sheet

- FCF and Stock Valuation

- Sensitivity Analysis

Some assumptions for valuing the share price of Teuer Company are to be used. From the period of 2013 to 2018 is used to forecast the financial performance and financial position of the company and how much change gain with changing assumptions of growth rate, discount rate and tax. The assets of the company, working capital, profit and loss of company, change in sales and expenses all these values are shown in following financial analysis.

Appendices

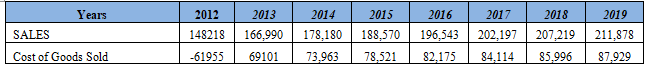

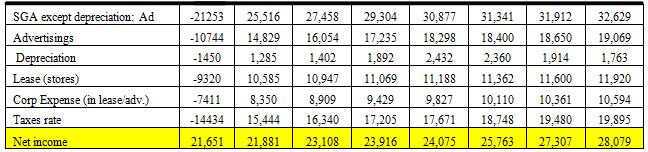

Appendix 1: Pro forma Income Statement

Net income is increasing from 2012 to year 2019 with an increase in taxes rate and Corporation Expense. Here the assumption of 40% tax and 5% corporate expenses is taken from the case exhibit for forecasting the net income for 2012 to 2019.....

Teuer Furniture (A) Discounted Cash Flow Valuation Case Analysis

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.