Super 8 Motel Guelph Case Study Solution

Given what you know from the case, would you consider the results of your analysis in

the Excel model to be an optimistic, pessimistic, or most likely scenario for valuing the

Super 8 Motel – Guelph? Why?

I have obviously used the pessimistic scenario for valuing the Super 8 Motel- Guelph case the pessimistic approach often focuses on the negative aspects in general. As I believe that its revenues would decrease in the future, because the existing consumers are expected to get well aware regarding the firm’s services and the firm would be unable to attract the new consumers, which could affect its earning after the taxes.

Assess the qualitative factors which would impact the valuation of the Super 8 Motel-Guelph.

After leading the hotel for almost two generations, Dean and his family were faced with the choice to sell. If they opt to sell the motel going to sell a motel; Dean would then be required to make the final choice to either accept the offer of $ 2.9 million or to reject it. Selection should be made in the connecting market where a great amount of unpredictability meets. Therefore the valuation of Super 8 Motel-Guelph is significant and important because of the qualitative factors possessed by the Super 8 motel - Guelph that are Industrial Growth method, Administration Quality. Company’s main business.

What do you anticipate will be the net effect of changing market conditions on the value of the motel?

As technical movements are crucial for the motel to stay sustainable to fulfill the guests’ orders and to achieve a strong market position. The industry’s past redevelopment schedule has changed over the years as an outcome of the ever-changing profitable condition and its business series. As the property’s value always increases with time; I can say that the value of the motel will always be on an increasing trend.

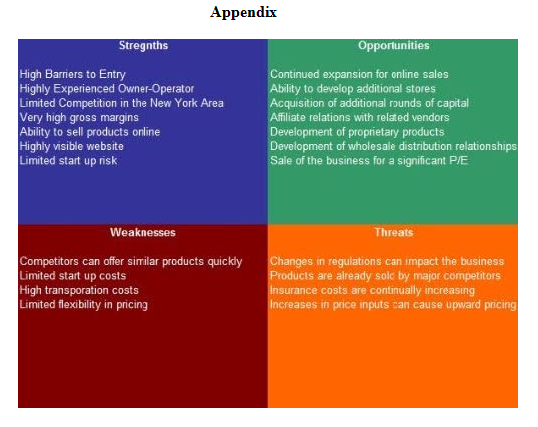

SWOT Analysis

Strengths

- The Super 8 Motel Guelph has a very good experience of running its business, which makes the business eligible to perform better in such-unfavorable and uncertain scenarios.

- Super 8 Motel Guelph has more than 19000 designs, which expands its customer support.

- Super 8 Motel Guelph has a crucial amount of money in R&D in comparison to its competitors.

Weaknesses

- Selling of the motel can give a negative sign to Super 8 Motel Guelph customers.

- Limited Flexibility in the pricing of their per room

- The competitors can offer better services as compared to the firm, with quick response as well as the application of advanced technology.

Opportunities

- Continue selling and buying can create numerous opportunities for the organization.

- Affiliate relationships with new vendors.

- Continued developments for online Bookings.

Threats

- Economic weakness in the country, which are the anticipated business divisions for Super 8 Motel Guelph, can build up numerous issues for Super 8 Motel Guelph.

- Changes in the regulations can also affect their business.

Recommendations

My calculations show the motel to be worth between $4,214,451, with $2.9million price offer; indicating that the family would incur the loss of($1,314,451); therefore the firm should not sell the motel. I suggest the super 8 motels Guelph to accept the offer of above $2.9million because at the moment they would suffer the loss. And no firm wants to get a loss of selling its property. So it is right now not to sell the motel.And if the offer price is higher than the 2.9million then the family could give the offer a second though and might sell the motel.

............................

Super 8 Motel Guelph Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.