Songy 2011 Case Solution

·Westminster Office

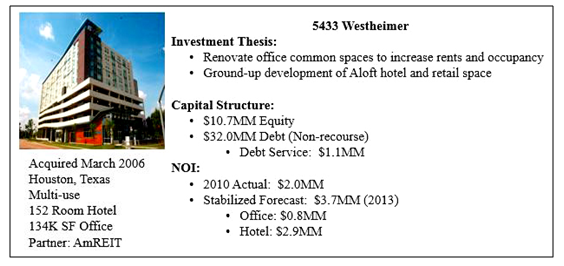

Song had a 5433 Westheimer Property in Houston. The 134000 square foot property was acquired by Songy in March 2006. The investment referred to a joint venture between the AmREIT and Songy. The asset properties are described in the image below

The loan was originally granted by Wachovia, with which the company had maintained a 20 years relationship. During the recession, Wachovia was acquired by Wells Fargo, with which Songy had no relationship maintained.The future prospects of the Westheimer office was uncertain. Songy asked Wells Fargo to provide a loan extension of 2 years. Songy required additional $4 million in order to bring the occupancy rate of the office building at 90%. If the plan went accordingly, office building generate NOI of $800,000 which could be sold at a cap rate of 7.5%. However, as the company had no relationship history with Wells Fargo, so it was not given the loan extension, rather Wells Fargo required Songy to sale the property to retire the loan.

The analysis concludes that Songy has two alternatives of selling the property or getting the loan extension and restructuring the office in order to generate an occupancy rate of 90%. The sale proceeds would entirely go to lenders, as it is determined that property would generate a net present value of $1.52 as shown below

However under the second alternative, Songy could obtain a $4 million additional loan and by restructuring it could bring the office’s occupancy rate at 90%, and if planning went well, the property would be able to deliver NOI of $800,000 and it could sold at a cap rate of 7.5%. It is assumed that the occupancy rate will grow by 90% in 2013. The cap rate is assumed to be 7.5% and the WACC is assumed to be 12.75%. The NPV after restructuring is calculated as $2.16 million, which is higher than the NPV generated by the first alternative of selling the asset. The revenue from the sale of the hotel would be 29.1 million, proceeds of which will be used to pay off the existing debt of $32 million, while the remaining $2.9 million will be added to the new debt of $4 million.

·The Carpenter Building

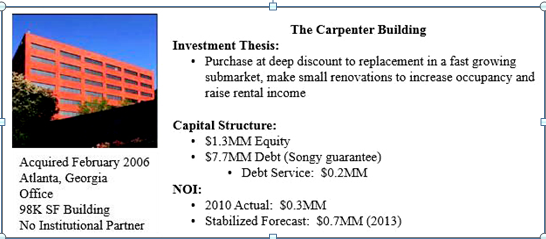

The company was also facing challenges with its 270 Carpenter Building, located in Atlanta. The 97000 square foot property was acquired by Songy in February 2006. David and his team foretasted the needs for the property in the upcoming two years.

They determined that the property would require an additional capital of $3 million for the tenant improvements and leasing commissions, which would bring stability in the property. However, Songy and the bank were anxious about the property’s value as it was expected to be lower than the loan’s face value. Songy had two alternatives to go for a loan extension of $3 million or to liquidate the asset and payoff the debt obligations.

Songy would not be able to generate a positive NPV from the property, and David and his partners would be less optimistic about the property’s future so they would be liquidating it by the end of the fiscal year 2011. Selling the property does not seem a viable option as it generates NPV of -3.48 as shown below. The sale proceeds will completely go to the lenders, not even leaving a single penny for the company’s shareholders.

The other alternative for Songy Partners is to go for two year loan extension till the fiscal year 2013. The valuation has been performed by making few assumptions i.e. the initial growth rate for the first 5 years is expected to be 25%, while the onwards growth rate is assumed to be 8.5%. The cap rate is assumed to be 9% while the weighted average cost of capital is assumed to be 12.75%. The valuation resulted that Songy should continue the project, as it would generate a positive NPV of $6.22 million.

Case Questions

Question 1

The significant outside factors, which could affect the David’s predicament include the demographic of the population in which the company is operating. The trends of the population could impact the real estate severely, which are often overlooked during an analysis. The other outside factors include the inclusion of interest rates, economy’s well-being, government policies and subsidies.

On the other hand, the human error factors which are attributable to the David’s predicament include underestimated risks associated with each investment alternative, high debt to assets ratio, wrong selection of the assets’ locations, low liquidity position and failure in managing the partnerships.

The outside forces are not manageable but it was in David’s hand to manage the human error factors. He must have addressed the risks associated with each asset before investing. Rational debt to equity ratio must have been used while keeping in consideration the uncertainty of the real estate market and the investment liquidity and location selection must have been kept into consideration.

Question 2

- David should make the $2 million down payment, as the sale of the asset would bring a negative NPV and all of the sales proceeds would be going to the lenders. However, making the payment in getting a loan extension would take a minimum of 5 years to generate positive NPV, so it’s better to make the down payment.

- If the Well Fargo allowed the company an additional $4 million loan for the office building and if there two separate loans instead of single collateralized then the property would have generated NPV of -$10.95 million as shown below, with a cap rate of 7.5% and the WACC of 12.75%...........................

- Songy 2011 Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.