SMITH FAMILY FP Case Solution

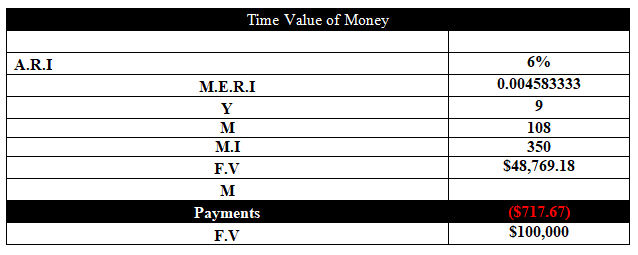

Amber believes that it is important to have $100,000 saved before Luke starts university.

One of the main goals of the family is to develop a plan to achieve the Regional Emergency Coordination Plan (RECP) for their children, for which they have decided to invest $100000 for their children which will be due after 9 years. In which, there will be 108 months with monthly installments of 350 each month. Therefore, the family has to pay $718with a 5.5or 6% annual interest rate in single payments for their future.

Comment on appropriate investment maturities for the Smiths’ savings goals.

Part A

Investment maturities associated with saving fora different car should not be done presently, because of the financial situation of the Smith family. The car is already in an excessive use by the family and it would be very difficult for them to delay the time of investment.

Part C

Bank term deposits are not feasible for the investment needs of the family,because the main reason is that the interest rate of RESP is 5.5% for 9 years as compared to rate which the bank is offering, with higher rate of interest than the term deposits.Therefore the performance of the bank would be good.

Part D

It is expected the rate of inflation would affect the Smith Family, as the prices always go up, which will reduce their savings. If the family keeps saving in the bank account, they would get the interest for all the savings, as the inflation would go up; the bank will give them higher interest and if inflation goes down then they would not get the same interest.

Part E

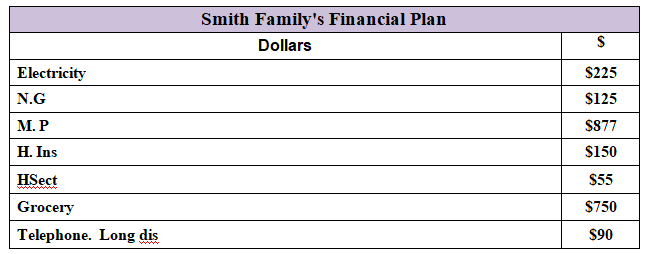

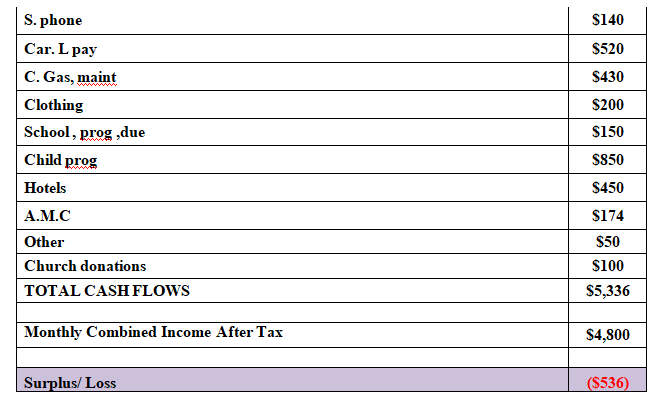

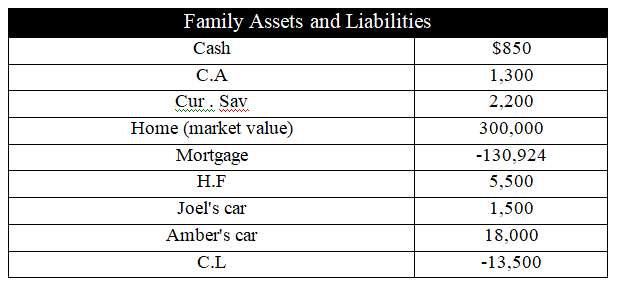

By looking the financial position of the family and their income statement and balance sheet, it is observed that they have a negative balance of ($536), which is calculated by deducting all the expenses from the income after tax. Therefore, the family does not have cash to have savings, becausethe family is spending more than it is earning. The habit of the family to have lavish cuisines at expensive diners or restaurants is causing them to have a peak in their expenses, which is hindering their ability to have sufficient cash for saving. In order to have savings; the family should downsize on their extra expenses.

Comment on the credit card offers the family recently received in the mail.

I think the credit card which the family has received by mail is a very good option because it charges a lower interest rate of 1.2 % for the first 6 months, which would help the family in living their lives better and making plans for a vacation that they have been thinking for.

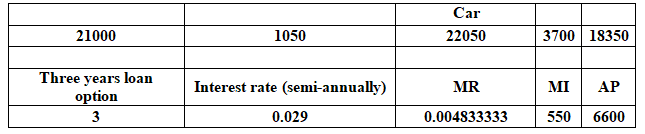

Discuss the Smiths’ options for a car loan.

The Smith Family has the option of a car loan, which has an original price of 21000 as of present. And the family wants to make payments for the car, but they do not want to pay more than 550 dollars per month, and by my calculation; the loan amount will be $18350 after subtracting the gross amount with the down payment.

Conclusion

By analyzing the case; the Smith Family should make a balance of cash inflows and outflows in order to reduce their financial issues, and they should have reduce their extra expenses in order to make their investment opportunities more diversified.

Appendix

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.