Situation Analysis of Rubicon MD Case Study Solution

Recommendations

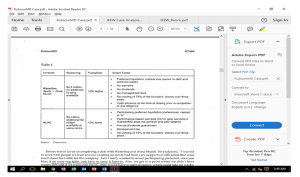

Considering the financial strategy of the firm, we recommend the company to choose the second option of financing i.e. Waterline with the other investors and drop the offer of NLVC because being a new entrant, the company is not in the capacity to bear external stress that would affect the growth of the company. As we can see through Exhibit 1 and Exhibit 6 that accepting the offer of NLVC is too expensive as they are not only demanding the security of annual dividend, but also asking for 10% control of the company in a way.

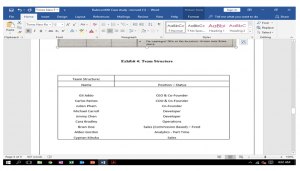

Considering the organizational strategy of the company, we recommend the company to add more people to their workforce according to the team structure provided in Exhibit 7. The company needs to hire an experienced and skilled person who can supervise the team and align them to work for the same objective.

EXHIBITS

Exhibit 1: Waterline and NLVC

Exhibit 2: Market Segment

| STRENGTHS

· The competitors are less. · By successful launching of IORA and Qliance, the company came under the list of five DPCs. · The achievement of a large hospital system boosted up the credibility of the company. |

WEAKNESSES

· Early investment problems. · Funding from different investors comprised of hefty terms and conditions. · Unexperienced staff to carry the business at its initial stages. |

| OPPORTUNITIES

· The company can exploit the 3 months sales cycle in other competitive market and can earn revenue almost three times of the following competitive market. · Other segments of the market can be chased by following the 90 in 90 concept. |

THREATS

· The main threat to the firm is from the offering capital companies who can take control of the RubiconMD with their heavy terms and conditions. · The incompetence of the inexperienced employees can lead to the ill performance of the company. |

Exhibit 3: SWOT analysis

| POLITICAL

· The healthcare sector can be affected by the Governmental policies such as legislation and insurance amendments. · Being an emerging sector of services, the company is sensitive to legislative variations. · Governmental spending can be influenced by tax policies. · Change in Federal Government can also affect this sector. |

ECONOMIC

· The economy will be benefited as the general health care services will be provided to the people who have no access to those services. · Increasing inflation will lead to unemployment and due to unemployment, people will not be able to pay their rates. |

| SOCIAL

· The trend of the growth in this market will be real as it is covering a larger range of audience including rural and urban individuals. · The variations in demographics and public values can influence the company. |

TECHNICAL

· Technology is somewhat a vital factor in the business of RubiconMD. · The company now needs to advance its technology by introducing its app comprises of the more advanced features. |

Exhibit 4: PEST analysis

| POWER OF BUYER

As there are a smaller number of substitutes available in the market for eConsultancy therefore, there will be a slight effect of the buyer's power. |

POWER OF SUPPLIER

As the company is providing web-based services, therefore, there is no effect on suppliers. Only suppliers in this business are the capital suppliers. |

| COMPETITIVE RIVALRY

The competitive rivalry is moderate as the market is an emerging market and the fewer number of substitutes are available. |

|

| THREATS OF NEW ENTRANTS

As the company is web-based and such kind of platforms do not require a heavy amount of capital to be initiated, therefore, a new entrant can easily challenge the company. |

THREATS OF SUBSTITUTES

The threat of substitutes is low for the company as there are very almost no substitutes exists in this market. |

Exhibit 5: PORTER Analysis

Exhibit 6: Financial Comparison of offers

Exhibit 7: Team Composition