Rubic On Md: The Current Case Study Solution

The CEO Gil Addo had personal experience that inspired him to bring up the idea to expand into the access of specialty care, that’s why in March 2013 the idea of Rubicon MD came into existence in a MIT Hacking Medicine Event where he discussed it with Reines and Dr. Pham. The idea behind Rubicon MD was to create web based platform where the Primary Care Providers can directly consult with experts, which would reduce costly referrals and provide assistance in areas where the experts are not available such as small towns and rural villages.

This memo indicates the current position of Rubicon MD with influence on the Finance, Sales, and Recommendations for the current problems that the organization has regarding its financing and strategic issues.

Financing Strategy: In seed funding or the Startup investment for Rubicon MD gained a $1.3 million by Dec 2014, and involved Waterline Ventures, the Boston-based investment organization and other investors such as Angel firms and Oxeon Investments. Current stockholders from the firm’s earlier seed round also contain health technology giant Athena health and former Blue Cross and Blue Shield of Florida CEO Bob Lufrano.

The seed phase was over for the organization and now came the phase for the next generation of funds (Series-A) to run the organization. The leader in the field of e-Consultant Rubicon MD declared the ultimate of their $4.0 million Series-A financing as the needed capital to grow the organization.

There were two options for the organization for the Series A – Financing, the NLVC and the waterline and Alma Mundi deals, their exact details are mentioned in the Exhibit (3) of the case. The NLVC offered 4+2 Million deal, with heavy terms such as guaranteed annual dividend payments, management fees, and performance based warrants. The other deal was the Waterline and Alma Mundi with 2.3 Million investment and relax terms such as no annual dividends, no management fees, and no warrants over the control of the organization. However, the money offered was creating a serious dilemma as 6 million and 2.3 million were very different and the organization needed funds due to its early life stages.

Sales Strategy: Rubicon has won the position in the direct primary care (DPC) and an employer outside clinics by pursuing the larger opportunities. In doing so, the productivity level and employees' satisfaction have increased by falling in the requirement of the individual visits. In April 2015, Rubicon MD selected their vendor who was representing the main indicator that the organizer expected would bring integrity in discussions with other hospitals.

The table mentioned in Exhibit (2) below retells about six major segments with market size, CAGR, and its sales cycle. These segments can be expanded internationally to gain more profit but would be difficult to implement it.

Organizational Strategy: In February 2016, Rubicon MD made team of four full-time employees. The team builds on different perspectives such as technology, product, sales, operations and analytics. Addo had hired new employee for the product developent which also helped in negotiation. Additionally, he hired a redesigner to redesign the existing products. In the operations segment, RubiconMD concentrated on refining the engagement of clinics, restrained the capacity of e-consultants acquiesced per user. Addo And Reins predictabed that in order to raise the growth they wanted more sales for support. That’s why he had hired the new sales executives to improve the sales department. Moreover, the Alden Gordon developed and analysed the return on investments for primary clients.

In short, strategically the organization’s main employees were inexperienced people being recently graduated, and needed a strict hand or control over their effeciency.

Recommendations:

We recommend Rubicon MD, in consideration of Finance Strategy to go for the other option with the Waterline and other investors and forego the NLVC deal as the organization is a new startup and does not need high pressures at the startup stage. As mentioned in the Exhibit (3) below, the Deal for NLVC is expensive for the organization resulting in annual dividends and management fees for the amount, additionally the valuation being provided to them will be more than 10% of control. For the Organizational strategy, as the organization has inexperienced team in relation to the strategic side of the organization they need more people to become a part of the organization, the team structure is further mentioned in the Exhibit 4 below. What the organization currently need to do is to hire an experienced controller, who needs to be brought in to reign in all the departments and personnel of the organziation so that the firm can stand together and focus on the future.

EXHIBITS

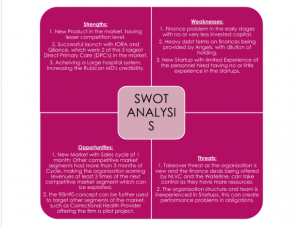

Exhibit:1 SWOT Analysis

| Team Structure: | |

| Name | Position - Status |

| Gil Addo | CEO & Co-Founder |

| Carlos Reines | COO & Co-Founder |

| Julien Pham | Co-Founder |

| Michael Carroll | Developer |

| Jimmy Chen | Developer |

| Cara Bradley | Operations |

| Brian Doe | Sales (Commission Based) - Fired |

| Alden Gordon | Analytics - Part Time |

| Cyprian Kibuka | Sales |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.