Recreational Properties Case Analysis

Introduction

The recreational property was founded by ten years experienced civil engineer Anders Forsgren. While the recreational properties mainly focused on the markets across Europe and made various deals by acquiring permissions from the EU Union Environment Agency to create recreational properties. The founder of recreational properties raised around $15M from a different group of investors and carried out its operations regarding the recreational properties. However, the company had specific policies through which it purchased the recreational properties and created particular improvements to raise the property's potential. The company then sold the property again within 3 to 4 years of durations.

The company uses recreational properties for various development in core facilities, roads, sewers, and other fundamental products. While due to some uncertainties, Ander Forsgren is stuck in a highly complex situation in the same season. However, he focused on three parcels of land which have the potential to use for the ski resort at the White Mountain development. While he acquired an option in June 2001 for $500,000 to purchase that parcels of land in June 2002 with a strike price of $10M.

Furthermore, a group of conservationists filed suit against Ander after purchasing his 6th opinion to stop the construction of the ski resort project. So that is why the European Union of Environment Agency refused to lease the land unless the court decided the case filed by a group of environmentalists/ conservationists. While the court would not reach any decision in time, Ander bears the loss option of purchasing and losing the deal.

Farming the Decision (Question 01)

Objectives

The main aim of this deal is to increase the financial return of Ander Foresgen through the developmental value. Through the development in the agreement of The White Mountain, the financial return of Mr.Adren would be increased because this deal has versatile features to create the financial return.

Alternatives

These two options stated that the option of buying Mountain Development should be exercised. At the same time, it will help to maximize the financial return of Modern through various projects in The development of the White Mountain is beneficial which help to raise the financial return as well as there is not any loss of time to sell the product and the development involved in the percentage increase capital cost. So, the main objective of Mr. Ander would be achieved through this deal by following the options.

Uncertainties or Risks

The decision to develop the White Mountain to maximize the financial return but the developmental deal raises certain risks that would be critical for Mr.Adern. The two options of decisions influence which net payoff would be influenced by uncertainties or dangers.

After the development of the White Mountain, if they could not make sufficient admiration for their resort to cut their additional returns, would they get the lease or not it is because of the lawsuits

The Emergency Meeting (Question 02)

The recombinant development of action regarding the uncertainty and the current options is to sell the property by doing effects. In the decision tree, it could be seen that if Anders gets the lease grant, it would be an optimal strategy for him to do the developments and then sell the property. Even without utilizing the options, the returns from the sale of property with growth are higher than that of selling it without any developments. Although, if Anders could use the options without uncertainty, it would have created value at a significant level. But in case of no utilization of possibilities because of the lawsuit and anticipation of getting no lease, it is recommended that Anders sell the property by doing the additional £5 million costs in the development as the returns could be higher. The estimated total return with lease and development is £14.92 million, even without exercising the option. However, the product's sale price is estimated to be £13.5 million. Hence, the property should be sold out with developments.

From the decision tree, it could be seen that if there is no grant of lease to the property because of the lawsuit, then the only amount that Anders could get by the sale of the property would be £9 million. However, it could either get £14.92 million or £13.5 million in the absence of a case.

Sensitivity Analysis (Question 03)

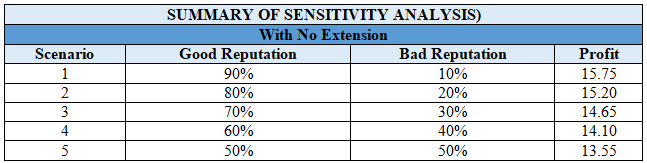

The Sensitivity Analysis for different possibilities is given below

From the Sensitivity analysis, it could be analyzed that if no extension for exercising the options is requested or granted, Anders should decide to sell the property with developments done by only investing £5 million of added costs until the possibility of a good reputation is more than or equal to 50%. Because up till that ratio, the return is more than the return from the alternative, i.e., £13.5 million.

Extending the Option (Question 04)

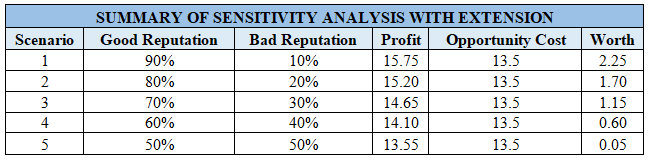

Suppose the option is extended for one year and exercised for the development, then with the sale of property with products. In that case, the worth of options according to various possibilities is analyzed below. Below, we have analyzed returns from different scenarios by comparing them with the opportunity cost of return from alternative investment, i.e., £13.5 million.

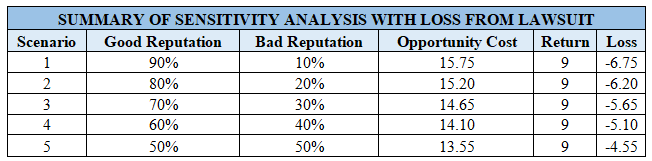

If the option could not be exercised because of the lawsuit, then the return from the property sale would be £9 million without a lease. Below, we have analyzed losses from different scenarios by comparing the returns with selling the property without the lawsuit, i.e. £9 million, to the opportunity cost of selling the property without a lawsuit.

A Meeting with the Landowners (Question 05)

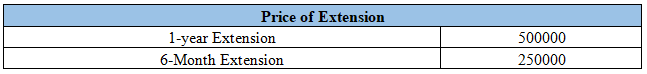

We have calculated the reasonable price that we have calculated for the six-month extension of the option as below.

If we compare it with its worth as determined in Answer 4, it could be said that the possibility of a Good reputation is equal to or more than 40%. The extension is worth it because the worth of the option after that limit would be below, i.e. (£0.05 million) than its reasonable price, i.e. (£0.25 million)...

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.