PROCTOR & GAMBLE Case Study Analysis

· Decentralization

The next recommended course of action for the Proctor’s management is to decentralize the business segments and provide autonomy over the division. It would ultimately benefit the organization, as the division heads would be motivated towards increasing the performance of the relevant business segment, by taking ideas from all employees and treating the employees like a team. It would increase the employees’ morale, motivation, commitment and productivity, ultimately bringing up increased product solutions, ideas, sales and profitability for the business unit and for Proctor & Gamble.

Decentralization would enable the company to bring up diversification in its internal processes, products and activities, which have been hindered and become complex by stringent and centralized systems, followed by the company’s top management.Further, it will lead to the development of standard metrics within different global segments, as the global segments would be having complete authority and the internal standards would be identified by each segment in order to improve the segment’s overall productivity and profitability.

· Exiting Product Development

Another recommended course of action is to develop the existing brands and their relevant market shares. It would help the company in increasing the sales figures and the profitability. The existing product may be based upon value addition according to the customers’ preference’s or delivering the same product to another target market, there by expanding the company’s customer reach.

Proctor & Gamble can develop its existing product portfolio by modifying and existing product or adding value to products, based on the changed preferences and trends. For instance, the company’s customers switched to other competitors during the crisis in order to maintain the affordability. Similarly, P&G can modify its existing products according to the needs of the customers. Another way of developing the existing products is to find out new potential markets. Even though, P&G has a large global presence and distribution network across the globe, but there must be more markets, which could be identifiedandtargeted, ultimately, enabling the company to expand its market outreach and improve its financial performance.

Implementation and Execution Plan

- In order to shut down the corporate business segment, the company should stop making further capital expenditures and it should sell out inventory in the market at lower rates, so that the company should focus on the other performing business units. Though the inventory will be sold at lower rates but its better to dispose of the assets.

- Secondly, in order to decentralize the business units the board of directors must choose or change the segments’ division heads by involving them into the decision making, which would give a sense of being important and connected towards the organization and the division heads will be motivated towards making their segment’s strategies and implementing the strategies to meet the company’s goals and objectives.

- Lastly to work on the existing product development, the company should understand the changing needs of the customer and then it should add value to the existing product, according to the identified needs. The company research the market and identify new potential markets, which could be targeted to increase its market share.

Strategic Management Practices

The three most relevant and best practices of strategic management involved in this case study include

- Understanding the Current Strategic Position

- Devising Strategic Options

- Implementation of Strategic Options

The Lafley’s leadership had demonstrate the best practices of strategic management in reference to Proctor &Gamble Position, H identified and understood the existing strategic position, whereby the company was focused upon a lot of brands, unnecessary for the company’s growth and irrelevant to company’s core business.

Afterwards, he worked on devising out the best strategic option for resolving the strategic issue and he cameup with the decision of divesting 100 brands in September 2014, which were deemed irrelevant to the Proctor &Gamble’s core business. Lastly, the implementation of the strategy involved the closure of specifics brands and sale out of different acquisitions, which ultimately lead to improved performance and company’s profitability.

Appendices

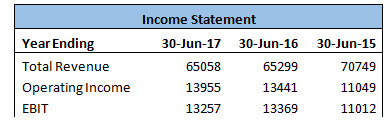

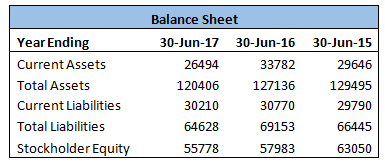

Appendix 1: Proctor & Gamble’s Financials

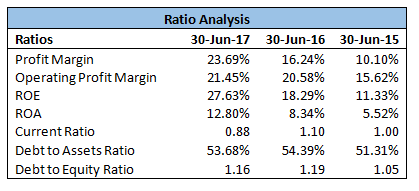

Appendix 2: Financial Ratio Analysis

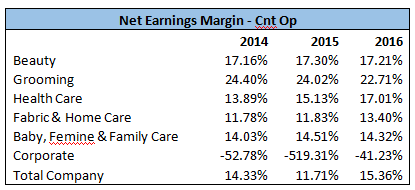

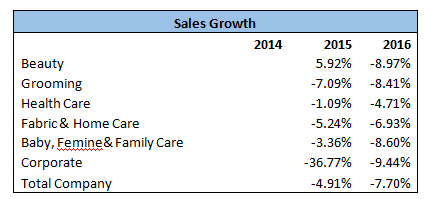

Appendix 3: Global Segments’ Financial Analysis

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.