“PRIVATIZATION OF LI & FUNG: RATIONALES AND IMPLICATIONS CASE” Solution

Background

Li and Fung were established in 1906 in the port city of Guangzhou, China by fellow benefactors "Fung PakLiu" and "Li To-Ming". The organization has been viewed as one of the most huge worldwide store network coordination models and its job as a worldwide broker and exporter stays at the center of its business.From the very start, the organization has developed itself according to the concurring political and natural circumstances. The organization is famous for providing item plans and advancement, unrefined substance and industrial facility obtaining, creation arranging and the executives, quality affirmation and product documentation to transportation combination. The organization's development has fundamentally expanded after the return of siblings Victor furthermore, William Fung from their studies. They entered the administration of the organization and advance its development.

In 1989, the occur rent shockwaves from the political and economic circumstances didn’t stay the organization public for the long haul and this accordingly finished in the privatization of the organization. The Fung siblings used the privatization to pull together the organization's energies, offering off non-center organizations to take care of obligations and smoothing out the center skills of product exchanging and retail. This elaborate a huge development of administrations in the exchanging business to incorporate contribution item plans and creation plans, obtaining unrefined components, and giving business sector and specialized data to makers and purchasers.

Problem statement

The case highlights the corporate finance issues arising in the company.This issue arises followed by the privatization of the company and its end stock cost flooded by 88.0%, from "HKD0.50 to HKD0.94", on the accompanying exchanging day.

Mission/vision statement

“The company’s main goal is to create the supply chain that is free from any digital disruption and US-china trade war uncertainties”

Situation Analysis

To assess the situation analysis, the following models can be used;

Swot analysis

The swot analysis is used to analyze the company’s overall internal analysis such as strengths, weaknesses, opportunities, and Threats. These analyses are extremely important to analyze the company’sweaknesses and make these weaknesses a future opportunity to resolve the company’s overall issues. Li and Fung Ltd. are profoundly assorted and adaptable in their inventory network by giving excellent items to the client while keeping up with the maintainability and acquisition. This serves as the organization's huge strength. On the other hand, when it comes to self-owned market and strategic planning production, the company does not concurwith it. Appendix 1 shows the company's overall swot analysis.

PESTLE Analysis

Pestle analysis is a strategic tool used to analyze the company’s overall external environment and its effects on the company’s growth and finances. Appendix 2 shows the PESTLE analysis of the company.

Revenue

According to the financial strategy of Li and Fung, it has been seen that:

- The organization has seen to expand its net benefits possibly in 2007 however lead to an extreme expansion in Intangible resources

- The Reserves and Surplus additionally expanded showing future obtaining plans.

- The Debt to Equity proportion for "2006 was 0.096" and in "2007 it was 0.5" demonstrating that the organization is protected

- The Steady benefit development from 2004 onwards has been recognized

Supply chain model

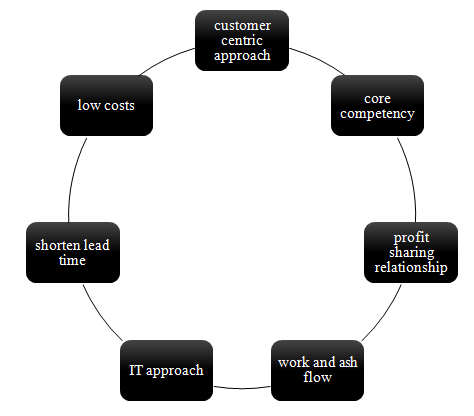

There are seven pillars of Li and Fung supply chain model, these includes;

Competitive Advantage

Few significant factors serve as a competitive advantage for the company. These include;

- The company has been extremely famous according to its customer-centric approach and its nature to respond according to the current market practices. The staff of the company is extremely well trained and friendly, that in any case if the customer has any issues or problem, they are free to adjust.

- The second main competitive advantage of the company is its globalization. The company has been sourcing in a couple of countries across many producers.

- Another main factor of the company that makes it highly competitive is its nature of products. The high-quality products and services provided by the company are what make the company worthy in the market.

Strategic Recommendations

The following strategic options are recommended for the company to achieve future development; these are:

- It is recommended for the company to focus on the market of China due to its high population rate. The progressions in Chinese financial improvement have caused a critical expansion in the expectations for everyday comforts of the Chinese public. This has made the critical expansion in the customer market in china. As the economies of the USA and Europe develop gradually and the market is now deep rooted, it is of fundamental significance for Li and Fung to build a piece of the pie in China to expand the net benefits.

- It is also recommended for the company to introduce its online e-commerce websites like Amazon or Alibaba. In the current technological advancement and era, E-commerce has great importance and is significantly worthy in diving the success................

- “PRIVATIZATION OF LI & FUNG RATIONALES AND IMPLICATIONS CASE” Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.