Principal Protected Equity Linked Note Case Study Solution

Risks Associated with the Derivative Instruments:

- In nature, derivatives are the highly volatile which lead to the potential losses rather than the investment returns. The valuation of derivatives are the extremely complicated which have not provide the potential accurate value of underlying assets.

- Basically, derivatives are the tool of speculation where the small mistakes during the prediction of the underlying assets prices might lead to the huge potential losses.

- Here, there is a counter party default risk which if occurred, might lead to the loss of option premium price.

Gain and Losses and Portfolio Objectives:

According to the ethical and professional standard of CFA Institute’s Code and Standards and by analyzing the gain and losses against the derivatives to which and investor should invest it in 1 million dollars to earn the good potential return from the bullish trend in S&P 500 index, it has been recommended to the investor to invest in future contracts because the future contracts are those contracts where the investor can hedge the future prices of underlying equity and its potential return will based on the future prices of underlying assets. It is the standardized contracts that is more liquid than the forward contracts. The future contracts can be reversed with any of the member in the stock exchange which means there is no any restriction to wait till the time of maturity as in the forward contracts.Here, as the bullish trend observed in the US stock market, the return on underlying equity can be determined at any time before the maturity.

Recommended Derivatives Opportunities:

The recommended derivative (future contracts) can present the opportunities related to the good potential return at any time during before the maturity which will lead to the good potential return as compared to the exercise of contract.

Exhibit 1: Differences between Futures and Forward Contracts

| Basis | Futures | Forwards | |

| Nature | Traded on well-organized exchange | Over the Counter | |

| Contract Terms | Standardized | Customized | |

| Liquidity | More liquid | Less liquid | |

| Margin Payments | Requires margin payments | Not essential | |

| Settlement | Follows daily settlement | At the end of the period. | |

| Squaring off | Can be overturned with any member of the Stock Exchange. | Contract can be overturned only with the same counter party with whom it was entered into. |

Exhibit 2: Black Sholes Model

| S | Stock Price | 1,100,000 |

| K | Strike Price | 1,000,000 |

| T | Time | 365 |

| R | Risk Free Rate | 6% |

| E | Exponential Term | 2.718 |

| N | Cumulative Standard Normal Distribution | 7% |

| s | Standard Deviation | 25% |

| Ln. | Natural Log | |

| D1 | 2.421 | |

| D2 | (2.356) | |

| C | Call Premium | 194,377 |

Exhibit 3: Best Scenario

| S | Stock Price | 1,100,000 |

| K | Strike Price | 1,000,000 |

| T | Time | 365 |

| R | Risk Free Rate | 5% |

| E | Exponential Term | 2.718 |

| N | Cumulative Standard Normal Distribution | 6% |

| s | Standard Deviation | 25% |

| Ln. | Natural Log | |

| D1 | 2.419 | |

| D2 | (2.358) | |

| C | Call Premium | 159,624 |

Exhibit 4: Worst Scenario

| S | Stock Price | 1,100,000 |

| K | Strike Price | 1,000,000 |

| T | Time | 365 |

| R | Risk Free Rate | 8% |

| E | Exponential Term | 2.718 |

| N | Cumulative Standard Normal Distribution | 8% |

| s | Standard Deviation | 25% |

| Ln. | Natural Log | |

| D1 | 2.425 | |

| D2 | (2.351) | |

| C | Call Premium | 213,385 |

Exhibit 5: Worst to Best

| Worst | 213,385 |

| Normal | 194,377 |

| Best | 159,624 |

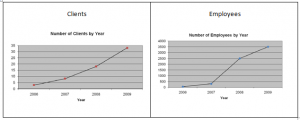

Exhibit 6: Graph from Worst to Best

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.