Pacific Grove Spice Company Case Study Solution

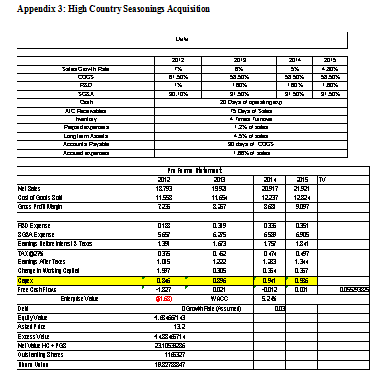

Appendix 3 shows the free cash flows generated by the acquisition of the HS Company. The forecasted percentages have been used to calculate the company’s free cash flows. The acquisition alternative generates positive cash flows $0.813 million in 2013, $0.758 million in 2014 and $9.815 million in 2015. A terminal value at an assumed growth rate of 3% is calculated in 2015 of $36.446 million approximately.

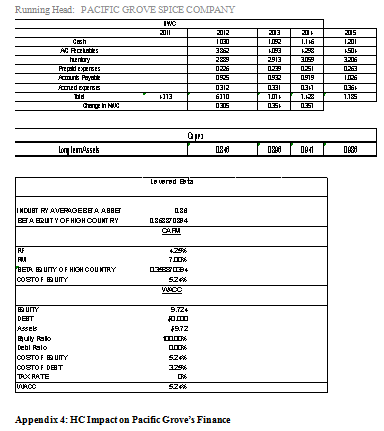

In order to calculate the weighted average cost of capital after the acquisition, the industry average beta of 0.36 was used for the calculation of levered beta (i.e. Unlevered Beta x (1+(1-T)*(D/E Ratio). Secondly, the cost of equity is calculated as 5.3%, at a risk free rate of 4.25% and 7% market risk premium. Afterwards, the weights of HS Company’s debt and equity are calculated respectively. The company is having 100% equity and 0% debt, which lead to the WACC of 5.24% at a tax rate of 27%.

Further, the cash flows are discounted at the WACC of 5.24%, which resulted in an enterprise value of $27.04 million. The asked acquisition price of $13.2 million is subtracted from the enterprise value, which resulted in excess value of $13.842 million approximately by the HS Company. In order to determine the share price of Pacific Group after the HS acquisition, the excess value by HS Company is added to the Pacific’s equity value and divided by the outstanding share, which resulted in an intrinsic value of $44.48 per share. It means that share are not overpriced and the intrinsic value is greater than the current market value of $32.6, ultimately creating a value for the company’s shareholders.

Question 5

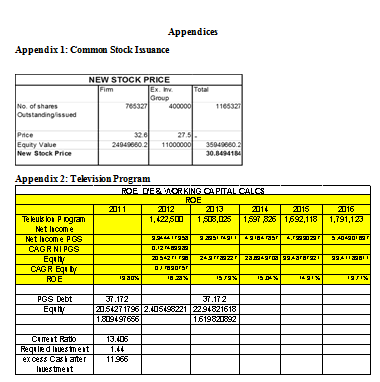

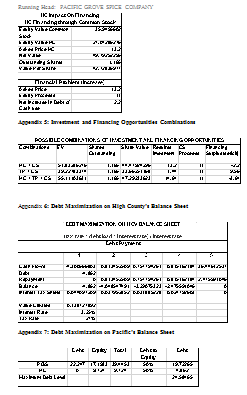

The acquisition of HS Company seems to be a viable opportunity as it is generating a higher intrinsic value even more than the current stock price. To see the impact of such acquisition on the financing needs of Pacific Grove, the acquisition is assumed to finance with the proceeds of common stock issuance. The equity value generated by the common stock issuance is added to equity value generate through the HS acquisition and the asked acquisition price is subtracted, which resulted in a net value of $49.7925 approximately (See Appendix 4). The net value is then divided with the total number of outstanding shares, resulted in a share value of 42.728 per share.

The asked price for the acquisition of HS Company is $13.2 million, however, the proceeds from the common stock issuance are $11 million, which will increase the financial problem of the company i.e. the company will have to generate excess of $2.2 million either through its own cash or by raising additional debt.

Question 6

The television program and the acquisition of HS Company will be financed with the proceeds of common stock issuance. The three possible combinations for the Pacific Grove are shown in Appendix 5. First of all, the enterprise value generated through the acquisition of HS Company and common stock issuance is combined together and divided with the total outstanding shares, which resulted in a share value of $44.47 per share. Similarly, the share values, among the other two combinations of television program plus common stock issuance and acquisition plus television program plus common stock issuance, are calculated as $33.66 and $47.292 respectively.

Moreover, the financing surplus or deficit is calculated by subtracting the proceeds from common stock issuance from the required investment in each combination. From the figures, it can be clearly seen that the highest value is generated by the third combination with a share value of $47.292 per share, however, it requires additional financing of $3.64 million. The second combination is not viable as it creates the lowest value to the shareholders with a share price of $33.66. The best combination would be the acquisition of the HS Company through the proceeds of common stock issuance as it creates a higher share value of $44.47 with a minimum financing requirement of $2.2 million.

Question 7

The company’s CEO wants to maximize the debt levels on the High County’s balance sheet and using the debt proceeds to pay off the debt. It is assumed that the maximum level of debt would be kept 50% of the total equity after deducting the current liabilities from the total assets. The debt level equalled to $4.862 million (See Appendix 6) after the proposed debt maximization assumption. The cash flows from the acquisition of High County is assumed to pay off the debt by 100%, which will lead to the debt balance zero at the end of year 5. The value created by debt is calculated on the basis on interest tax shield. The total value generated by the interest tax shield on debt resulted as $0.138 million approximately, at the interest and tax rate of 3.25% and 275 respectively.

Question 8

The CEO made another option of acquiring the HC Company and maximizing the debt on the Pacific Grove’s balance sheet. The debt and equity levels of Pacific Grove and HC Company are combined, out of which the maximum debt level is calculated by adding the 50% of the total equity on both of the company’s balance sheets. The maximum debt level is calculated as $24. 584 million approximately (See Appendix 7).

The cash flows generated by the acquisition of the HC Company are assumed to pay off the 50% debt i.e. maximized on the Pacific Grove’s balance sheet. Additionally, the value is calculated the interest tax shield on the maximized debt payments at a tax rate of 27%. The value is calculated as $0.89 million, which means that the company has sufficient solvency position in order to finance the acquisition of HC Company.

..........................

Pacific Grove Spice Company Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.