Loewen Group Case Analysis

Introduction

Loewen is the leading company in the wholesale building material industry it is a Canadian private company that is founded in 1905 by Cornelius Toews Loewen and the headquarter of the company is located in Steinbach, Manitoba. (Kachra, 1998)The company has a well-known brand that provides variously unbeatable combinations of artisanship and environmental sensibility in a widespread line of Douglas fir and Mahogany windows and doors.

Hence the company utilizes Mahogany windows and Douglas fir in their products so that is why it is the best Canadian millwork producer of wood door and windows systems for light commercial and residential use. Furthermore, in the 90s the company expand its distribution in various other countries including the United States, and the United Kingdom, and become the leading company that supplies custom wood windows and doors.

Problem statement

Loewen is the second largest company across US and Canada regarding its services and operations in the death care segment. However, the company is now facing various issues regarding financial debt and the massive acquisition strategies of the company during the 90s. The decrease in the death rate and the worst conditions in the market lead the company’s market place shrink as the company spread its acquisition all over the 46 states in the USA and Canada as well.

Loewen's competitive strategy

As the company followed various growth strategies regarding the growth of the market in the death care services during 1960 the death rate was increased up to 0.8% so that is why the market offers limited growth opportunities on the other hand continuously fragmented into various segments for the growth of the market. As Loewen had a strategy that could reduce the higher fixed costs which were faced by the several new entrants while these issues could be regulated by merging of several businesses. While on the other area of growth is pre-sales where most of the customers preferred to purchase the death care services before their death hence the shares in the cemetery and funerals revenues grew from 22 percent to 44 percent during 1995 while in 1998 the revenue grew from 61 percent to 75 percent.

The company provided various services regarding death care in a market where the market competition was not that complicated. The death care services market is the most stable as compared to other markets while it has lower competition. With the steady death rates, the company had various advantages in the generation of revenue and cash flow before providing the services while it can maintain the market shares that aid the company to be stable.

The growth strategies of the company significantly differed from its competitors which include SCI, however, the capital was financed, and the aggressive sales tactics were avoided which help the company to build a strong marketplace and better financial stability. Furthermore, the company had limited growth potential and the company depended on the acquisition of smaller competitors where these strategies required a large amount of capital.

The Financial Position of Loewen

The Financial position of the company is not good because the financial policies of the firm are not positively working. The performance of the company is weak with higher debt and interest expenses. In the next question, the financial position and performance of the company are explained. The financial position of the corporation is shown in the graphs which are attached below in Appendices.

Is the company at risk of Bankruptcy?

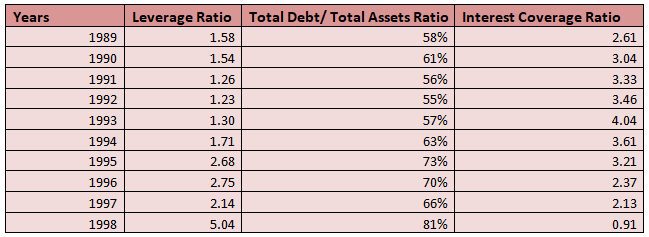

After analyzing and understanding the financial position of the company we can say Yes the company has the risk of bankruptcy. Since 1993 the leverage ratio of the corporation is continuously increasing as shown in the table. The leverage ratio reached a higher level of 5.04 from 1.58 which is not good for the company. The company has higher debt which also increases its interest expenses of the company. In 1998 the company has higher debt as compared to the equity. The debt to asset ratio of the company is 81% which is very risky for the company. The higher debt-to-asset ratio is harmful to both the borrowers and lenders. In the higher Debt to asset ratio, the investments are to be discouraged. A ratio greater than 60-70% is very risky for every business that’s why the Loewen group corporation has the risk of bankruptcy. The interest coverage ratio of the corporation is also very low less than 1. In the 1989 and previous years, the company has a higher interest coverage ratio which is good for the company. The company has a higher interest coverage ratio in the year 1993. In 1998 the company faced serious issues of higher debt, higher interest expenses, and higher debt to asset ratio. These all issues decrease the income and profit margin of the corporation by increasing expenses. Bankruptcy takes a huge cost of thousands of dollars in which fees of filing and fees of attorney are included. At the start of the bankruptcy procedure the $800 to the judges by 850 US and 100 Canadian businesses as the marching fee for the businesses....

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.