IS THAILAND ATTRACTIVE FOR HONG KONG ORGANIZATIONS? Case Solution

Attractiveness for Corporations and Business Entities

Thailand will be helpful for the organizations which will seeks to invest and open up business centers and a part in the Thailand, the following points are listed below:

- Prices of the properties are low in Thailand mainly, for organizations – cheap rentals or premises purchases will help bring down the capital expenditures in startup of the business.

- Thailand is considered an EXIM country, which means it is recognized for high imports and exports destination which is helpful for EXIM organizations with added benefits and government support.

- It represents the largest market in the Asia which have seen high growth in the current times

- In the recent times FDI has been high in Thailand which makes the government policies and increased economic perspectives.

- Cheap Airfares for ongoing traffic is also a support feature, with the executives and other operative staff, and machinery landing cheaply in the country – reducing additional costs of startup and operations

- As the country is connected to many countries with its border sharing and also with heavy links to China, the exports and imports to China are of cheaper costs and can support a business in this perspective.

- Thailand is a great tourist attraction country, Marketing and promotion companies will flourish due to number of tourists taking up essentials when they visit.

- Limited capital gains tax, stamp duty, or transfer fees for private investors which can be used in partnership entities by a business

- Low inflation and tax features of the country, is the greatest feature for any business as high profits can be earned on the limited tax payout features.

- And etc.

Above described were the main features of the economy of Thailand, now we will be considering the Government’s policy current for the FDI from individuals and after that phase we will directly consider the impact of benefits of Thailand for the Hong Kong based organizations.

Government policies in the last two decades has been highly considerate in incorporating and Increasing the FDI of the country, more over this has related to the controlling of the low taxation rate, capital gains tax, and other special privileges are provided to businesses through the government front authority of Board of Investment (BQI).

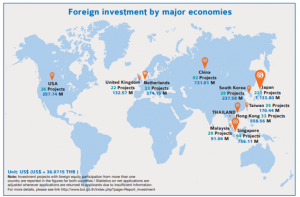

Other ways of promotion by the Government is in cases of providing government grant, subsidies, and tax reliefs for instance the government has deemed areas into zones, and industrial zone -1 contains tax exemptions for years as that area is under rural population and there is high government backing for that industry zone. Further the Zone – 1 has 50% reduction in import duty on machineries needed to be imported for the organizational setup, and raw materials are also exempted or 50% levied duty for year 1 of the operations. After all these ratios it can be seen that during the last decade Singapore and Japan are the highest FD Investors in Thailand, now though the process is changing and other countries are also emerging into the market of Thailand because of its heavy growth perspectives. This can be seen in the chart below, which shows the FDI of other major economies in Thailand, taken from the data from 2018 early:

(Review, 2018)

According to the FDI chart above; China, Japan, Singapore, and Hong Kong are the top players in the market of the FDI with approximately $ 721.01 Million, $ 1,133.8 Million, $ 756.11 Million, and $ 558.56 Million respectively.

The European markets also have an interest, but not in proportion to these Asian Markets. After the financial crisis which affected the market in 1997, Thailand’s government broke the FDI into smaller segments as it does not want to be directly related to any one government or country and not directly be affected by losses of the Investor Country.

To sum up this part, the FDI is the backbone of Thailand, next to tourism and this has been appropriated by the Thailand government as well, further these policies have broken up the FDI and future gains to the economy are expected to occur in the near future.

SPECIFIC TO HONG KONG

Now, we will be considering the specific benefits to the Hong Kong based organization upon investing further in Thailand. First of all, we will be discussing the main benefits which will eventually lead to master marketers and analysis of different managers and officials under this criteria. Upon the chart provided above, Hong Kong’s current FDI in Thailand is at approximately 12.6% ($ 558.56 Million) which makes it one of the top countries with relations with Thailand.

This can be exploited by new businesses, as the government will have specific gratuities and subsidies in place to help the organization at the start up. Further, the trade rout of the country is at beneficial advantage as both the countries are located near to each other and the transportation and travelling space and time will both be beneficial.

Cultural and social differences are not many, as the Thai People and the Hong Kong have about similar cultural practices and traditions as their very next to each other. An example of this can be taken by the Indo-Pakistan area with both countries have differences with each other but sharing somewhat the same cultural practices and races. So, this will be easy to setup as their will not be much barriers to the managers in grasping the demand and the needs of the people in that region.

As Thailand is a tourism backed country, Hong Kong can benefit from this as there are lot of flow of people who comes to visit Thailand during the year. Marketers of promotional brands will benefit in the process as they have diverse background people walking in the markets, fashion brands will also seek benefit as the range of consumers are diverse and not of the same class.

According to Theerapan Nunthapolpat; the general manager of Siam Commercial Bank – Hong Kong branch – he gave the interview to the Nation News Paper that returned in excess of 5% of the total investments. He further mentioned that Condominium Units were priced mainly between 5 Million and 10 Million Bahts, which has seen the real estate investors to consider the Thailand market as this was at least 3 times cheaper than the Hong Kong based real estates. Further the islands of Thailand, Pattaya and Phuket has seen considerable rise in the number of Tourists which has led to the real estate market shift from the local investors of Hong Kong to move towards these places. Further the most expensive condominium project in Thailand is 550,000 THB per square meter, which is about any high place in Hong Kong.

Another reason for increased investments for the Hong Kong investors and businesses is the low rate of interest return which are at global levels of 0.02% which is very low, this also can be a beneficial way for businesses to invest in Thailand to achieve 5-6% growths on their investment amounts.

Further according to the bank manager, said that the Hong Kong firms and real estate giants have also raised awareness and has created presence in the Thailand market, they have sold many projects and it is good for the management also if they want rental services which would earn 5-8% on their returns.

Apart from this, well-established developers and hotel management companies have also initiated offers which provide guaranteed returns on investments, this is very much successful in the Hong Kong market, due to measly returns.

As the chart can be seen which provides that 12.6% already has been associated with Hong Kong, and the west has started to recognize this as they have also doubled their investment from the last year as the economy is stable and provides evenly returns to their amounts with providing security as well.

Recommendation for my Company

I am currently working for the HSBC Bank, which is in Hong Kong. My advice after the consideration of the Thailand’s current economy, its position in the GER and other factors.

It would be my suggestion to go ahead and invest in the real estate market of Thailand, as this would earn my bank and other people specific 5-8% of returns which will be hard to maintain if we invest the amount locally.

As according to the trend, and the economic capacity and sustenance of Thailand, real estate will grow in the future, and commercial lands and other parts provide a specific time barred opportunity to currently invest which will be closed in future, if deliberations are not performed right now.

Further, as mentioned by the general manager of the Siam Commercial bank, which is of the same industry, I think we should follow their approach as this will be beneficial to the organization, and to the overall stakeholders of our organization.........

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.