Hart Schaffner & Marx: The Market for Separately Ticketed Suits Case Study Solution

SEGMENTATION ANALYSIS

There are four appropriate methods to segment the market, which are: geographic segmentation, demographic segmentation, psychographic segmentation and behavioral segmentation. The demographic segmentation method is used by separating the groups on the basis of different age groups, gender, educational levels, the number of people in a family, their work-related background, income level range, and much more. Demographic segmentation is the most extensively practical method for segmentation. The behavioral segmentation method is used to break down the practice in which the consumers make their judgments during the buying process. Behavioral segmentation distinguishes the customers on the basis of their product selections, the way they like the product, the way they use the product and the way they recognize the product. Behavioral segmentation can break down the clients on the basis of their awareness of particular products, and on the basis of their individual characters. For instance, the extroverts or the introverts.

Traditional out fitclients are diverse than high quality separates, because the clients of traditional clothing wear the suit as a uniform, while separates users do not wear it on are gular basis. Consumers buy traditional clothing for regular use whereas, the clients of separator clothing buy suits infrequently. For traditionally clothing, men and women both make purchases on the consistent basis.However, for separator clothing, women make frequent purchases. To sum up, these two products are not similar,but are entirely different from each other. After examining various segmentation tools, it is recommended for the company to use the demo graphic method for segmenting the target market for separators.

TARGET MARKET

In order to produce high quality separates, the company should target the age group of 30 years to 45 years as, it is the age of constancy, where the income range of an individual is at its high level due to their all attention to wards their earnings. Thus, the age group between 30 to 45 years is appropriate to the segment as the target market for separators. The main features of this age group is that, their expenses are at higher level as compared to other age groups. Therefore, they spend their money on valuable products just to get the familiarity and try exclusive products in their lives. This segment is the best segment in terms of separators, because it is the self-service shop which offers the finished products according to the requirements and wants of the customers. Thus, the target age group of 30 years to 45 years is appropriate for the segment for newly launched clothing product called separators.

QUANTITATIVE ANALYSIS

We have done break-even analysis for all the 3 products as shown in Exhibit 4.The total break-even volume of sale must be 135,248 products. Although, to achieve the zero profit, the company should sell 62,422 units of coat, 31,211 units of vest and 41,615 units of slacks. There would not be a dismantle result on both of the company’s products, because of the totally changed target market, which cannot affect the sales of one product after the induction of a new product.

The cost and price are recommended to company that would be charged right to customers, according to which,the price for Coat, Vest and Slacks would be $82.84, $165.67 and $124.25 respectively. Also, the price charged to the retailers would be $542.20 for all items as shown in the Exhibit 5.

RECOMMENDATION

After taking the analysis into including, situational analysis, market and quantitative analysis. It is recommended to the company that it should initiate a line of quality separates. The reason behind which is the fact that the company would be able to hold the market share and boost its profit margin after a new line introduction for quality separates.The target market is aged between 30 and 45, and the anticipated growth rate of this target market is 70 percent, which means that the market is expected to grow in the upcoming years. Thus, introducing quality separates would grow strong brand image, and the demands would remain stable or increase with the passage of time. The product would target the customers who show different behaviors, and have different preferences. Encompassing the line of product would be beneficial for the company, because it aids to the sustainability of the company’s position as the largest producer of quality products in the marke.

EXHIBITS

Exhibit 1: SWOT Analysis

| Strength

· Leading company · Strong brand image

|

Weakness

· Inefficient allocation of funds to advertising |

| Opportunity

· Distinctive product · Brand equity |

Threats

· Threats of competitors · Adapting new technology by competitors |

Exhibit 2: The Porter’s Five Forces

| Threat of new entrant | high |

| Threat of substitution | low |

| Power of buyer | low |

| Power of supplier | high |

| Competitive rivalry | high |

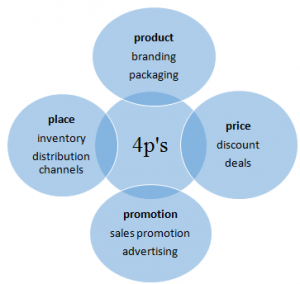

Exhibit 3: Marketing Mix

Exhibit 4: Break-Even Analysis

| Coat | Vest | Slacks | |

| Sew and press | $ 4.88 | $ 1.50 | $ 1.88 |

| Cut | $ 1.00 | $ 0.30 | $ 0.25 |

| Other variable labor charges | $ 3.23 | $ 0.99 | $ 1.17 |

| Fabric costs | $ 10.00 | $ 2.50 | $ 7.50 |

| Findings costs | $ 6.00 | $ 1.50 | $ 1.20 |

| Variable cost for the product | 25.11 | 6.79 | 12.00 |

| Selling price | $ 50.00 | $ 15.00 | $ 20.00 |

| Working capital cost | 3.10% | 3.20% | 2.90% |

| Inventory cost | 0.80% | 0.67% | 1.10% |

| Bad debt expense | 0.70% | 0.70% | 0.70% |

| Order Processing cost | 0.25% | 0.25% | 0.25% |

| Miscellaneous Expense | 0.15% | 0.15% | 0.15% |

| Sales commission | 5% | 5% | 5% |

| Sales Ratios | 10.00% | 9.97% | 10.10% |

| Cost | $ 5.00 | $ 1.50 | $ 2.02 |

| Total Variable Cost | $ 30.11 | $ 8.29 | $ 14.02 |

| Fixed cost | 1700000 | ||

| Contribution margin | $ 19.89 | $ 6.71 | $ 5.98 |

| Break even volume in total | $ 135,248 | ||

| Annual volume of seals | 75000 | 37500 | 50000 |

| Ratio | 46% | 23% | 31% |

| Break even volume | $ 62,422 | $ 31,211 | $ 41,615 |

Exhibit 5: Cost and Pricing

| Cost and Pricing | |||

| Coat | Vest | Slacks | |

| Variable cost | 30.11 | 8.29 | 14.02 |

| Number of units | 75000 | 37500 | 50000 |

| $ 2,258,250 | $ 310,875 | $ 701,000 | |

| Total variable cost | $ 3,270,125 | ||

| Fixed cost | $ 1,700,000 | ||

| Total cost | $ 4,970,125 | ||

| Price | $ 6,212,656 | ||

| Price per units | 82.84 | 165.67 | 124.25 |

| cost per unit | 66.27 | 132.54 | 99.40 |

| Total cost per unit | $298 | ||

| Retail Price | $542.20 | ||

| Retail Price | [(Cost of item) ÷ (100 - markup percentage)] x 100 | ||

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.