Giberson Glass Studio Following Harvard Style Case Solution

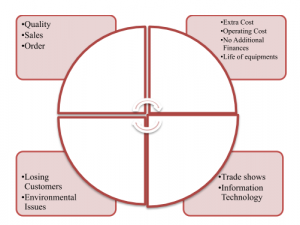

SWOT Analysis

SWOT analysis is essential in understanding the strengths and weakness of business, the strategy for any business is formulated on the strengths of the business to achieve the opportunities while mitigating the material effects of weakness and threats. In the figure 1, we have analyzed the strengths, weaknesses, opportunities and threats posed for the business. We have analyzed that there are several artists who prefer Giberson Glass studio due to their quality, we also see that the extra cost and inability to raise capital to expand for Giberson Glass is great weakness for the business. There are several opportunities for business to amalgamate new ways of producing glass and make use of trade shows to increase their sales. The environmental issue lingers for the business, as they are dumping 50 pounds of glass every day, which is affecting environment and might trigger penalty for the business by the local government.

Conclusion

Felicia Coates was responsible for consulting for Giberson’s Glass Studio. The issue with Giberson’s Glass Studio is that they are spending too much money. Giberson’s financial resources have been deteriorating ever since his wife stopped with the bookkeeping. This suggests the importance of an accountant and record keeping in any business. The issue with Giberson is that he is unaware of how much each product cost, and he does not know the profitability of each product that he makes. Therefore, Giberson is unaware of what he should products he should discontinue, and what products he should make more.

In order for Giberson to be more successful, he needs to track what types of products are profitable. The criteria for production costing consist of batch-wise cost, production time and weekly production. The solution proposed is to maintain the batch-wise costing and maintaining recordkeeping which allows us to break down the real issue. The business is in loss right now, and he needs to find the perfect batch wise cost to get the minimum margin profit. Mr. Giberson also needs to hire someone who could maintain record keeping of his books. The other main issue Giberson was facing was as much as he was interested in expanding his product portfolio and he failed to expand his product portfolio because he did not know how to price each of his product and which product to add in his portfolio and which one to discontinue. To further, expand the product portfolio Mr. Giberson needs to identify the products and obtain information about it production costs and market selling cost. Later, Mr. Giberson would be required forecast the sales and make decision by choosing among the products, and he will be required to implement the decision as planned and evaluate the performance of the product in market.

He always had considerable amount of disposable glass as waste at the end of each week but could not reduce it as he believed it would affect the quality of the product. As his personal savings are already decreasing due to unprofitable business, Mr. Giberson is required to put all the efforts to reduce cost and increases sales; as he is on the verge of bankruptcy. The structural change is required as we can analyze that there is high volume demand for his product “Wrapped Tumblers.” The product with high demand is prioritized usually by the business and works as cash cow product for the business. Mr. Giberson sells his high demanded product at lowest price of $8.00. Mr. Giberson has also received numerous offers to fulfill “made to order” products that existing customers personally requested, but has yet to complete any of the order.

Solution

We propose the solution that, he should assess these factors individually and accordingly come up with recommendations to improve the end motive of profitability.

1) Raw Materials: The total weight of raw material that was used during manufacturing was 39.3 lbs. (after calculations). The total weight of the raw material amounted to 50 lbs. contrary to the 39.3 calculated raw material. The available batch size is accounted to be around 200 lbs. Thus, the resultant percentage utilization of raw materials is just (39.3 + 50)/200 = 45%. While the Cost per batch is $21.42, the overall cost per year is $21.42x40 = $ 857. We recommend Mr. Giberson to reduce the quantity of the batch which is around 200 lbs. to preserve quality. If he decides to reduce the quantity used in batch wise by 50%, then he would be able to save around $429 annually.

2) Time Resources: After doing some calculations over the total “Hot Time” needed to produce the 4 items (roughly 19 hours) over a week and comparing it with the total available “Hot Time” which is 5*6=30 hours since Giberson blew glass from Tuesday to Saturday. So, this leaves us with the percentage utilization of 18.58*100/30 = 62% which can be definitely improved upon. Suggestion: Giberson could use this time to full capacity to produce more items. He could also use this time to expand his portfolio by taking new requests from his customers.

3) Pricing: To find the right pricing strategy we first need to calculate net profit/loss that the firm is currently incurring. After doing the calculations, the total revenue that was generated in a year was $31,000. While the cost of the raw material per year was roughly $850. Also, the operating costs come out to be ~$57000. Thus, the total profit is $31000 - $850 - $57000 = - $26850 Thus the business is currently generating a loss of around $26850 per year.

4) Profitability of individual items: After taking the fixed and variable costs into account, we calculate the overall cost of producing each item. Then we compare the overall cost to the selling price to determine the profitability of each item. What we find is that “Vase” is the most profitable amongst the 4 items. Also, the other 3 items seem to be highly underpriced. We suggest that the company should correctly price the other items apart from the “Vase”. They should also utilize the extra hot time to produce more vases since it is the most profitable.............

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.