Foreign Investment In Russia Challenging the Bear Case Study Solution

Above mentioned examples are particularly related to the price stickiness which cannot affect the price of a particular commodity by changing in demand and supply curve due to the changing in other commodity prices. The examples provided are not directly and immediately affecting the market prices of a commodity but they are firstly impacting on the inflation rate and then due to an increase in inflation rate the interest rate increases which adversely impacting all the commodity prices such as oil and gas prices and energy prices.

Current Domestic and International Economic Situation:

The current domestic and international economic situation in Russia is worst because at the start of the year of 2009, Russian government fiscal policy became more simulative in which government introduced a huge reduction in corporate and small business income taxes which are down to 20 percent from 24 percent and 5 percent to 15 percent respectively.

More of it, due to an increase in consumer price inflation around 15 percent and its negative impact on the Russian exports and its domestic growth, the Russian government have made the policy to slow down its real GDP growth to around 3 percent for the year 2009 because the Russian economy is expected to move slowly which requires to maintain the strong fiscal policy for the year 2009.

Domestic and International Economic Policies:

As the current domestic and international economic situation in Russia is worst because at the start of the year of 2009, Russian government fiscal policy became more simulative in which government introduced a huge reduction in corporate and small business income taxes which are down to 20 percent from 24 percent and 5 percent to 15 percent respectively. These new tax cut policies for Russian corporate and small business income taxes are combined leading towards a decline in the government revenues, resulting in a huge government budget deficiency, which has proven to be the great issue for the Russian government.

More of it, due to an increase in consumer price inflation around 15 percent and its negative impact on the Russian exports and its domestic growth, the Russian government have made the policy to slow down its real GDP growth to around 3 percent for the year 2009 because the Russian economy is expected to move slowly which requires to maintain the strong fiscal policy for the year 2009. Due to these two main reasons, it has been concluded that the Russia is not following the appropriate economic policies.

Country Risk Analysis and Crises in Russia:

One of the basic tools for analyzing a country’s economic risks include the value of the country’s currency in the international market. Moreover, another tool for analyzing there country’s risk include the rate of inflation in the country. Along with it, the rate of interest in the country, the trade account, the budget deficit/surplus and the commodity prices are also basic tools for analyzing the risk a country is facing.

With the analysis of all of these metrics for Russia form the case, it could be said the Russia is facing huge economic crisis in the current situation. The value of its Ruble is depreciating against the US dollar at a rate of 30%. Moreover, the country is currently facing a trade and a budget deficit due to decline in its exports and commodity prices in the international market. Along with it, the rate of inflation in Russia is also at its peak due to the currency depreciation against the US dollar. The rate of interest in the country has also increased substantially, which resists the productive investments in the country. On the basis of all of these tools of analyzing a country’s economic risk, Russia is facing acute economic crisis. The major cause of this economic downfall is the Global Recession of 2008.

Strategy to follow by MLC while going for Expansion in Russia:

MLC Company should follow the foreign exchange hedging strategy while going to invest in production and distribution facilities in Russia. The reason to choose the foreign exchange hedging strategy is to protect the business form unexpected losses which could arise due to the harmful currency changes. The foreign exchange hedging strategy can be customized for the purpose to hedge the flexibility in budget rates, for the purpose to protect the risk threshold and to avoid the harmful market outcomes.

Changes in the money markets can happen far quicker than human response times. Utilizing computerized Market Orders, you can guarantee that your business is set up to saddle opportunity or secure against drawback hazard when unusual moves happen.

Economic Performance of Russia:

The current economic condition of Russia is showing that the current account surplus of around 100 billion dollars in the treasury of Russia in the year 2008 has reached to its weaker position in the last quarter of the year 2008 due to a heavy declined in energy prices. The up comings of Russia is heavily dependent upon the up comings of oil prices in the global market which will be rise in future according to some experts of the industry.

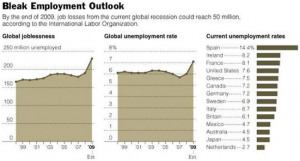

The president of Russia named Dmitri Medvedev speaks about the alarming figures in Russia during its exclusive discussion about the economy of Russia in its exclusive interview with CNBC which is the biggest news network in United States. In his talk, Russian president specially talked about the rapid increase in an unemployment rate in Russia due to the shutting down of many industrial production sector.

More of it, Russian president also highlighted the expectations about the decline in Russian’s Gross Domestic Product (GDP) which will be at least 6 percent in 2009 and will be nearest to the 7.5 percent in same year, it is considered the huge figure which have not seen after the collapse of the Soviet Union.

The results of this will heavily impact on the Russian’s international reserves which reduced the government’s ability to promote its counter cycle policies. A decline in the performance of the global economy in the year 2009 will lead towards the withdrawal of foreign investments in Russia in upcoming years. The results of a decline in foreign investment for Russia will lead to the high supply of Russian Ruble in the market which depreciate it against United States dollar. That is why Russian government have fixed the ruble rate from 26 to 41 against United States dollar.

Exhibit 1: Russia’s GDP Growth

Exhibit 2: Worldwide Unemployment Rates during 2008

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here