FINANCE EXAM Case Study Solution

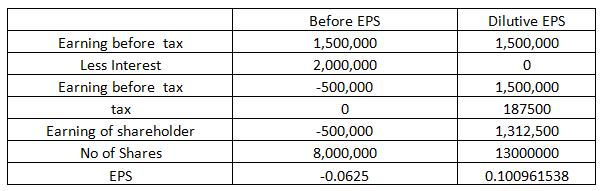

Question 1

I have calculated the EPS by calculating the earning of the shareholder first, and I have the no. of share already,so by dividing the earning of shareholder with No. of shares, we can get the EPS

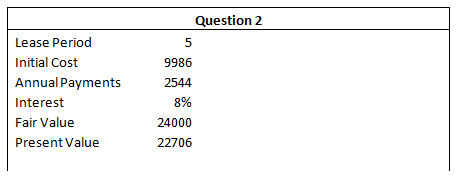

Question 2

According to IFRS 16, the finance leases should be recorded as an assets along with a liability at the lower of the fair value or present value of the minimum lease payments. In this case, the fair value of the finance lease of a distribution van is 24000 pounds and the present value of minimum payment amounts to 22,706 pounds. So, the finance lease will be recorded as an asset and a liability at the minimum present value of 22706 pounds and the depreciation for a useful life of 5 years will be deducted annually from the balance finance lease, at the end of the fiscal year.

On the other hand, the annual payment of 2544 pounds would be reported as an expense in the income statement, whichwould reduce the liability in the balance sheet createdunder the finance lease. The depreciation would be recorded under the operating expenses and the interestpayment on lease would be reported as an interest expense in the profit and loss statement.

Question 3

- Accruals are simply the expenses, which have been recognized or incurred but are not paid by the company yet, or accruals can also be the income which is recognized or earned but is yet to be received by the company. For examples: service revenue receivable $35000 or the interest accrued.

On the other hand, provisions refer to which may not be uncertain completely, these may be certain partially in a way if they incur cash outflows from the business. E.g. provisions for bad debts, long service leave $500,000.

- Contingent liability refers to a condition that there are probable and impossible chances of resources’ outflows from the business, depending upon the occurrence or non-occurrence of an event. E.g. Damage awarded against KKD, ranging between $20,000 – 7 million.

On the other hand, provisions refer to which may not be uncertain completely, these may be certain partially in a way if incurring cash outflows from the business. E.g. provisions for bad debts or long service leave $500,000

- Accrual.

- Provision.

- None.

- Contingent Liability.

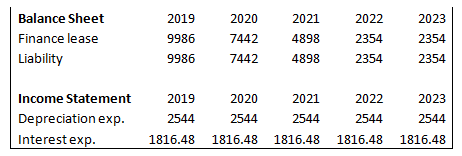

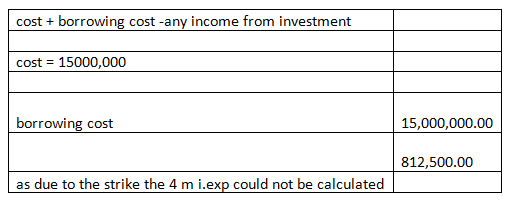

Question 4

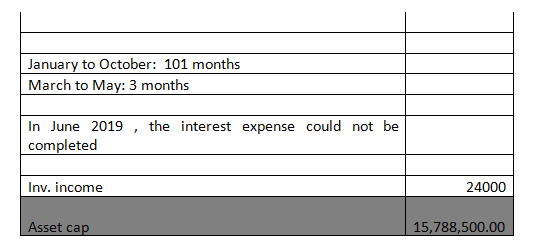

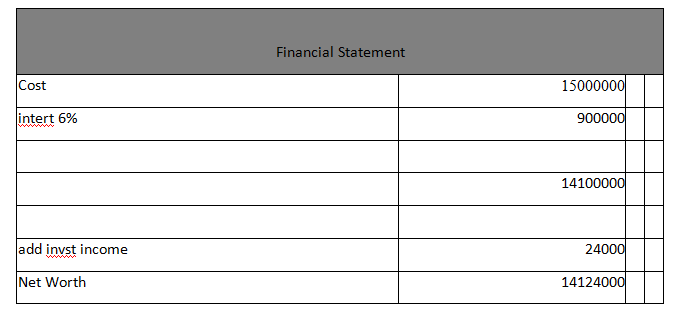

In order to calculate the asset capitalization I first find out the cost which is 15000000, then I calculated the borrowing cost to be 812,5000 and inv. income was given as 24000, so by adding 15m and 812500 and subtracting 240000, the answer we get is 15788500.

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution......................

FINANCE EXAM Case Study Solution