EVALUATING VENTURE CAPITAL TERM SHEETS Case Study Help

What items the entrepreneurs should focus most carefully on?

Edward Lopez and John Stevens, the two young entrepreneurs full of passion and skills in their respective fields, initiated a startup namely Universal MobileApps, Inc. with a seed funding of $300,000 in form of convertible notes from Languita Angels. These funds were used to develop and test the product. And now, both of the entrepreneurs are considering to raise more funds to achieve their long term goals.

The two entrepreneurs have been successful and have approached various big mobile devices manufacturers and other technical companies like Google to form and technical partnership. This approach has resulted in attracting two venture capitalist organizations. Universal has received two term sheets for venture capital funding from Red Baron Venture Capital and Top Gun Venture Partners. Considering these term sheets both of the entrepreneurs should focus on each and every term of the term sheets which affect their roles and authorities in the organization. Along with it, the entrepreneurs must evaluate the amount of funding required and raised by each funding alternate. They must also evaluate qualitative along with quantitative benefits of each term sheet.

How do various terms impact their return if the company does well?

The answer for this question can be given by conducting a thorough quantitative and qualitative analysis of both of the alternatives.

Quantitative Analysis: Capitalization Table

Top Gun Terms

Top Gun enlisted several rights along with some specific term and conditions. The investment will be made by only one investor. Top Gun’s term sheet listed total investment of $4,000,000. The post money valuation would be $9,000,000 and allowing a 25% pool option. In addition to this, the share price will be $1 per share and the Series A preferred Shares would be converted into common shares at any time on a 1:1 ratio base. The fully diluted shares will be 20% of the total shares and same percentage will be allocated for the ownership right.

Red Baron Terms

Red Baron enlisted several rights along with some specific term and conditions. The investment will be comprising over two investors. Red Baron’s term sheet listed total investment of $6,000,000 and the RBVC will invest $3,000,000 and Other Venture Firm will invest the remaining amount of $3,000,000 by the mutual consent of the company and RBVC. The post money valuation would be $12,000,000 and allowing a 15% employee pool option. In addition to this, the share price will be $1 per share and the Series A preferred Shares would be converted into common shares at any time on a 1:1 ratio base. The fully diluted shares will be 25% of the total shares and same percentage will be allocated for the ownership right. The attached excel sheet contains all the calculations related to the two options. (Ilya Strebulaev, September 12, 2013)

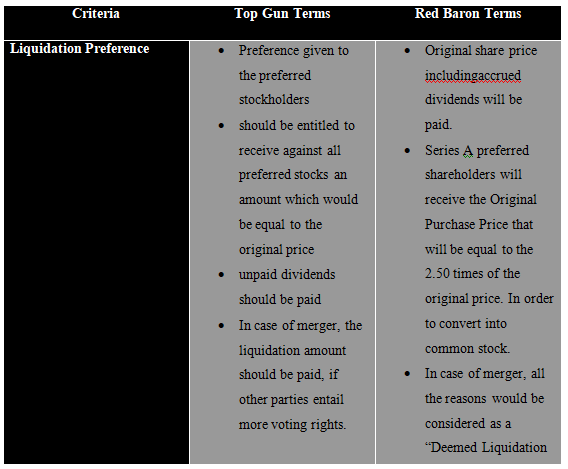

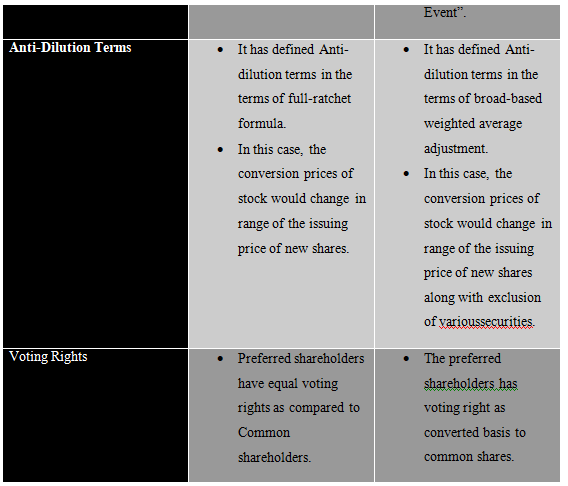

Qualitative Analysis: Liquidation Preference, Anti-Dilution and Voting Rights

The qualitative analysis is summarized in the following Table 2.

Table-2: Qualitative Analysis

How were the venture capital term sheets affected by the outstanding convertible notes?

Lopez and Stevens, as stated above, started with a seed financing in form of $300,000 in worth convertible notes from Languita Angels. The convertible notes with a list of terms and conditions affects both of the term sheets in terms of capital ratio given under each term sheet to the two owners and the venture capitalist firm. Moreover, it affects the future numbers of preferred shares based on its automatic and volunteer conversion. It also impacts the liquidity of the firm which ultimately affect the reliability of the venture capitalist firms.

What is missing from these term sheets?

The term sheets do not contain the rights of Lopez and Stevens if the two venture capitalists fail to comply with the term sheets. Moreover, these terms do not take into consideration the terms under various conditions of the convertible bonds that provided the foundation of Universal. This may create problems in various conditions already signed under the convertible bond term sheet. This is the reason behind both of the owners being recommended to evaluate and analyze various situations and the role of convertible bonds in both the term sheets. (Brigham, 2016)

With only a few days before the term sheets expire, what should they do?

Firstly, Steven and Lopez must extend the date of expiry via raising the inclusion of convertible notes related terms in the term sheet. Simultaneously both of the entrepreneurs must consult with the attorney to discuss the legal implications of both of the term sheets. After these two steps the owners must go for an evaluation of the qualitative and quantitative benefits and loopholes of both the alternatives provided in the previous sections. In the end, equipped with full information; the owners must go for an option with the highest benefits and the lowest legal risks..................

EVALUATING VENTURE CAPITAL TERM SHEETS Case Study Help

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.