Euro Zone Convergence, Divergence and then what? Case Analysis

Introduction

Euro Zone Convergence is the case about to regulate the rates of the eurozone in coming years by considering the edging variation in the long rates as an associate to principal charges. (Debaere, March 07, 2011)The European monetary union was established in the year 1990 and it perceived that the conjunction in interest rates would lead to a decline in the budget in entire Europe. Arturo Rodrigo has decided the eurozone junction in the procedure of growth in which the GDP of lesser income budget countries rises than the high-income budget. The rates of the Euro harshly fall as a link to the German rates. In this situation, the level of borrowing increases because of declines in the cost of borrowing. The development of the European monetary union was expected for the integration of the economy and conjunction in Europe. The increase in the dominant debt crisis and macroeconomic differences directed to the financial crisis. The GDP can increase with the increase in global demand or decline in the rates of interest.

Problem Statement

What was the track of the main euro Region in long-term interest rates expected to be over the next year?

Was the histrionic weakening in German long rates over the past two years a deviation that would soon be upturned, or was it part of the “original standard” that would persevere for some time?

How would sideline long rates change proportional to main rates?

Was the histrionic deviation in euro-region long rates likely to persist, or would the coming year see conjunction?

Major forces driving the GDP of Italy

The major forces driving the GDP of Italy are the growth of capital stock, rises in labor involvement, and technological development.

Growth of Capital Stock

The growth in capital stock increases the value of the corporations which directly increases the Growth of the country. The capital stock is the major component for every country to increase the value and wealth of the country.

A rise in labor inputs

The growth in GDP is also because of the increase in labor input. The employees increase their involvements in their duties which increase the outcome of their labors. An increase in outcome increase the value of the companies which is last added to the gross domestic product of the country.

Technological Development

The development in technology also increases the GDP of Italy. The advancement in technology is the major tool for Italy to grow its GDP. The technology increases the revenue of the country because with the technology the companies attract more customers.

The factors which affect the Forecasting of the GDP of Italy are the natural resources, human resources, technological factors, and capital goods. These all are factors that majority affect the forecasting of the growth domestic product of Italy.

Major forces driving the GDP of Spain

The major forces driving the GDP of Spain are the few sectors that boost the Gross domestic product of Spain those are the manufacturing sectors, mining sectors, and agricultural sectors. These all the sectors increase the GDP of Spain and make the country more valuable and powerful. The factors which affect the Forecasting of the GDP of Spain are little efficiency, the rate of unemployment is high, climate issues, unsustainability, and inequality. These all factors affect negatively the growth of gross domestic product and that is the reason the country is facing an economic crisis.

Forecasting Comparison

In the forecasting, the Euro Area is compared with the other three countries that are Germany, Spain, and Italy. In the forecasting, the Net Debt, Gross Domestic Product, and Euro Zone landing and borrowing are forecasted from 2013 to 2025.

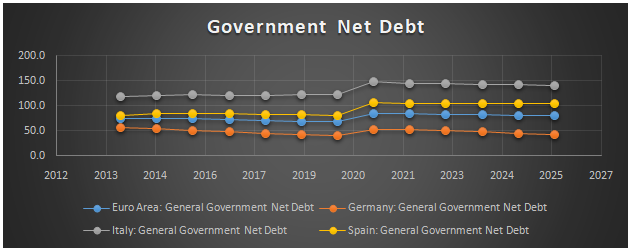

General Government Net Debt

The Net Debt of Germany is less than the other three countries which means that Germany has a good financial position. The Highest Debt is Italy’s government as shown in the graph. It means that Italy has low revenue and Germany has the highest revenue in all these three countries. On the second number, the Spain government has a low debt which means that Spain has also good revenue.

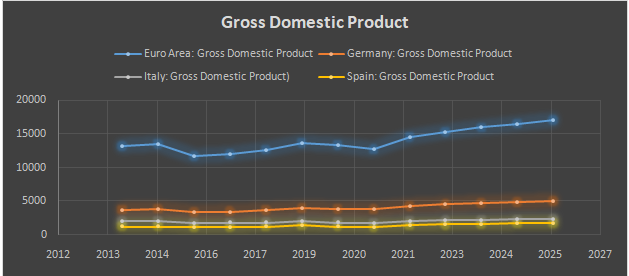

Gross Domestic Product Forecasting

As shown in the graph the GDP of Spain has very less as compare to other countries. The Euro Area has the highest GDP because it has many countries. In the second number, Germany has a high Gross Domestic Product that’s why the country has an advanced level of technology and high revenue….

Euro Zone Convergence, Divergence and then what Case AnalysisThis is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here