Dell to Lenovo Case Study Solution

Problems, Progress, Prospects relative to Peers

Due to investments in Marketing and Research and Development activities, Dell has certainly picked up some pace to make progress in the market. Although the problems that the company is currently facing is that it has not been considering the changing market needs. The prospects of the company will certainly change by investing in digital transformation and cloud computing needs of the customers. This will provide an edge over the competitors thereby allowing it to maintain a strong position in the market. (Balakrishnan, 2015).

Key Issues, Progress and Pitfalls of PC Industry

The issues that the industry is facing at the moment are the changing customer needs and ever improving technological environment. Innovation is the only key to success which will fuel up growth for the Computer industry.The market competitors should incorporate quality improvements, technical specifications and product innovation in order to ensure their survival in the market. PC industry is considered to be one of the highly competitive industry where multiple brands are competing to gain market share and churn out profits. In order to remain competitive in the market,there is a dire need to invest in R&D on a continuous basis to keep up with the changing trends and to align the growth strategies with market dynamics. Also, competitors might face the issue of managing cost so many product might over weigh the advantages of being able to offer products that would more closely match the customer needs.

Strategies of Competitors in the PC Industry and their Impact

The competitors in the market have adopted different strategies to strengthen their position within the industry.Apple has adopted the strategy of product development which is intensive growth strategy which also offer attractive products to customer in order to boost their performance and grow market share. Apple implements such a strategy via innovation in R&D process. Another strategy used by apple is the market penetration in which it sells more of the current product of company. Whereas, the growth and business level strategies of Lenovo includes; continuous innovation, differentiated products, investment in R&D activities, technology and product development. In contrast, the growth strategy of dell has built on various core elements such as; extensive data, build-to-order manufacturing, customer service, mass customization, partnership with supplier, direct sales, Just In Time inventories, and sharing of information with customer and supply partners. HP is focused on cost saving in any stage of the global operations; the persistent operation’ review has fostered the efficiencies of production as well as better production of the product to meet the needs of customers. The competitors are similar due to their consistency in producing the high tech or innovative product and their ultimate goal of offering the high quality, superior value, customized system, relevant technology, superior support and service and differentiated services to customers. The competitors are different industry hence it can be expected that Dell will have a promising future due efficient management of its position in the market and to maximize the market share. Such strategies would allow the market competitors to gain the competitive advantage, maximize market share, boost performance and increase production output.

Question 04

Financial Analysis

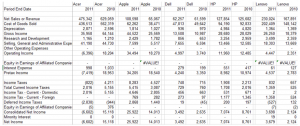

Considering the financial statements of all the companies provided in Exhibit 1 and 2, we can say that the profit margins of all the companies are varying by a high margin where Acer posted a Net loss of $6600 during 2011, Apple posted Net posted of $26,000, Dell posted net profit of $3500, HP posted net profit of $7000 and Lenovo posted net profit of $3650 which shows that Dell and Lenovo are in the same category of profits whereas Apple has earned substantially higher profits as compared to other companies and Acer posted a huge loss. So far, performance of Dell is considered, we can say that Dell is performing fairly well in the market as it posted profit during both the years in 2011 and 2010. Considering the size of sales for its competitors, Dell is making only about $60,000 whereas all its competitors are making sales more than $100,000 figure but the profits fall almost in line with other competitors such as Lenovo and HP whereas Apple and Acer have above average net income.

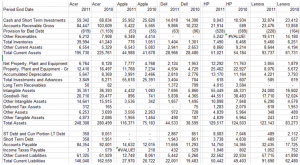

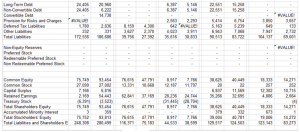

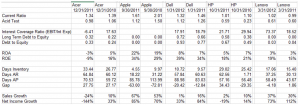

Also, considering the size of total assets of Dell when compared with their competitors, its 40% lower than the competitors since it’s about $45,000 whereas all its competitors have more than $100,000 is total assets during 2011. This shows that Dell is efficiently utilizing its assets to churn out sales as compared to its competitors since ROA of Dell is 7% during 2011 whereas all its competitors have an ROA of 3-5% only except that Apple has an ROA of 22% during 2011. The current ratio of Dell is more than its competitors too, which stands at 1.46 times as compared to 0.99-1.61 times for all its competitors. It is only Apple which has outperformed its rivals by maintaining a ratio of 1.61 times whereas all other companies have maintained a maximum ratio of 1.34 times. But when compared with the acid test ratio, Dell has the most promising liquidity position in the market. Return on equity of Dell has surpassed all of its competitors by maintaining a ratio of 34% during 2011 whereas all other competitors maintain their ratio around 15-34% in the same year.

After analyzing the financial positions of all the companies, it can be concluded that either Dell is performing relatively better than its competitors or at par with the industry hence it can be expected that Dell will have a promising future due to efficient management of its business operations.

Question 05

Options for Chan in the Industry

As such, Chan has option to whether to maintain its relationship with Dell and continue to hold its position in dell or it should make investment in one of the competitor of Dell such as Apple, Lenovo etc.

Pros and Cons

The advantages of maintaining the relationship with Dell includes; the company would benefited from the maximized market share of dell, positive brand image, market presence, product customization and competency in acquisition & mergers. By maintaining the relationship with Dell, the company can enjoy the first mover advantage. In contrast, if the company fails to grab the market share and fail to meet the customer demands, the company would lost its feasibility or viability of investing in such company.

On the other hand, if Trinity Fund Inc. would invest in any of Dell’ competitors such as Lenovo, it would result in various market opportunities to explore or capture in an effort to maximize market share and strengthen the market position. In contrast, the downsides of investing in Lenovo is the uncertainty and risk associated within vesting in new company. Also, the financial position of the company indicates that the level of un certainty is high of achieving the returns.

Recommendation

It is to recommend that Chan should maintain its relationship with Dell and continue to hold its position in Dell, the reason behind such decision is the future prospects, right structure for continued success and continued track record of Dell success. The company is now being contemplating to expand service and enterprise solution businesses, obtain more patent via acquisition, strengthen its presence on the emerging market arena and tablet market growth. Also, the financial health of Dell shows that the company is growing into its capacity, financially secure in short term, and effective in converting the money it has invested into the net income. Whereas, the market competitor such as Lenovo has not been generating massive profit return, the investment would not be viable or feasible for the investors in both short term and long term.