Challenges and Opportunities in Developing FM Services for Newly Constructed High-Rise Office Building Case Solution

The Kingdom of Saudi Arabia is facing increased demand in business growth, placing further pressure on the major revenue provider company, KHA Company. Therefore, Aramco is under continuous development strategies to upgrade its dynamic Building services to support its business and people by working in a sustainable environment.

To measure the challenges and opportunities of this service, number of fundamentals are considered on perspective of… finance, quality, flexibility, safety and security. From the review of literature and current Buildings in Saudi Arabia and KHA Company, this paper measures the current Facility Management practice that is undergoing in one of Aramco Head Quarter Buildings in Dharhan, Saudi Arabia Al-Midra Building.

The paper will explore how Al-Midra Building is being operated by looking at the current decisions regarding its operations and applications of managing the building. In an attempt to establish best-practice for KHA Company new buidling Al-Midra 2, it is found based on accessible information that the building operation lack number of essentials. First, … second, … , therefore they should… The new Building scope is still under development so future research opportunities to measure an effective TFM to the building is viable and achievable.

INTRODUCTION

Global Facility Management Services

The global facility management services market is expected to grow from $1,361.71 billion in 2022 to $1,562.42 billion in 2023 at a compound annual growth rate (CAGR) of 14.7%. The facility management services market is expected to reach $2,557.57 billion in 2027 at a CAGR of 13.1%. This massive growth in this sector highlights the level of significance globally.

The emergence of technology innovation and smart cities has gained massive popularity in the market of Facility Management which is apparent in the companies by expanding their service portfolios through integrating technological offerings and innovative information and communication practices. Transforming the conventional offices through artificial intelligence reimagines workplace interactions, which offer employees a smarter, safer, and more effective workspace. All these advancements provide exceptional employee experience and optimize the existing level of service provided (Research and Markets, 2023).

Saudi Arabia Facility Management Services

On a regional scale, Saudi Arabia is going through a transformation journey of reducing the country’s reliance on oil revenue. The support by the government to locate industries has become an important effort for this transition. Several plans within the kingdom have been announced since the introduction of Saudi Arabis vision 2030 on April 2016 to generate economic growth and create industrial localization.

Such plans are to promote the development of private sectors which will generate job opportunities for the Saudi Arabia Facility Management labor force and is expected to create huge market opportunities for number of sectors such as building & construction, heavy engineering, and automotive (Figure 1 shows the building development Riyadh the Capital of Saudi Arabi, 2023).

FIGURE 1. Omrania, 2020.

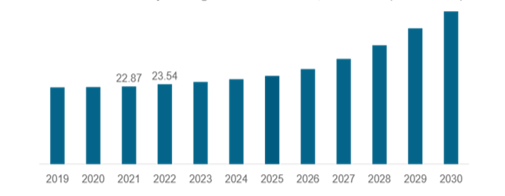

One major pillar that will contribute to the infrastructure growth in the country is privatization. Therefore, by looking at the below analysis, it is forecasted during the period of the implementation of vision 2030 the Facility Management market share is expected to grow from USD 24.28 Billion in 2023 to USD 43.48 Billion (Figure 2), exhibiting an annual average growth rate of revenue of 8.6% during the period. The demand of the Facility Management (FM) in the middle east countries, specifically the Gulf countries is facing massive expansion as its being supported by each Gulf country government by their construction activities.

while increasing the emphasis on green building practices. It is worth mentioning that FM is rising in the Gulf countries because large organizations are focusing on outsourcing non-core operations to independent contractors. This approach helps in improving the cost spent and increase in talent, and have more chances to invest in new technologies, and training to enhance the level of internal knowledge and benefit from the outsourcing approach (Mordor Intelligence, 2023).

FIGURE 2. Mordor Intelligence, 2023, Saudi Arabia Facility Management Market Size.

Saudi Arabia FM Market Segmentation

Based on the Service Type, the market for Facility Management in Saudi Arabia is divided into soft services, hard services, and other services.

The hard services contribute the majority bulk of the market services with a percentage range between 40%-45% (Figure 3). Examples of provided services are mechanical and electrical maintenance, Building fabric management, cleaning, drainage and plumbing, HVAC, safety and security, elevators/lifts.

Due to the significant investments the kingdom is contributing to the infrastructure facility development the ranges from construction of buildings, airports and roads, the demand for the hard services will certainly increase as this infrastructure will require regular maintenance and operation............

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.