Business Idea: Adding A Supervised Play Area For Children To All Whole Foods Grocery Stores. Case Study Solution

Profit-generation:

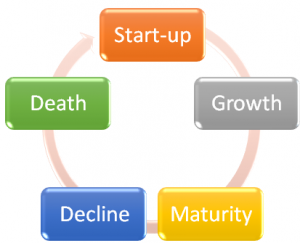

As the business idea will travel through different stages of life cycle, the company will get many chances to reduce costs and increase the revenue. In the beginning of the launch of the idea, there are chances of facing initial loss but the budgeted costs and estimated sales shows profit in the first year of the project’s launch (Exhibit 3) this means from the very beginning the company is generating profit. In the next few years the sale is increasing by a good percentage and it keeps growing till the third year. This is the best time for the company to generate profits and reduce costs. The company can introduce something that’s an add-on like a gift on winning some kind of game or reaching a high-score, this will keep attracting customers. There is a high chance that maturity period will be prolonged if the company keeps bringing new ideas to cater the customers. These ideas won’t cost the company a lot and they can enjoy a good amount of sales. This is a grocery store and so they can merge the two businesses and introduce deals, like on shopping for a good amount will get your child an hour of free time in the play place. This will boost the sales of the store and attract children and parents to the play area as well. When the cycle reaches the decline stage the company will need to incur some costs to introduce a new initiative to attract customers. Otherwise the business idea will move to its death stage where the company will not be able to keep the business idea running.

Phase-out plan

After the decline of the business idea there comes a time when the project comes to an end and no matter how much you invest and try to revive the business it does not come to life. Prior to this situation the businesses start to make their phase out plans. Phase out plan is when you withdraw all the efforts from the business idea and shut down the idea totally. Another way to have a phase out plan is when the company plans an initiative along their business that gives a boost to the business. (Bjernulf, 2016)

In this case the company can introduce a gaming zone along with the kid’s play area. The steps to initiate the gaming zone will be;

- To plan the initiative thoroughly and budgeting the costs and profits.

- They need to advertise it and make it attractive for the teenagers who do not want to do grocery shopping with their parents.

- The company will have to order inventory from suppliers, such as video games and hi-tech computers to make it more attractive.

- The pricing should be minimal to attract the customers.

- Initially, they will have to introduce it by giving out coupons and vouchers.

- In order to support the two businesses they can introduce schemes where the toddler and the teenager both can enjoy and the parents have to pay the minimum amount. This can also include a membership card which will assure the loyalty and frequent visits of customers.

Part II

- State your intentions for managing and balancing the scope-time-cost triangle. (Westland, 2018)

- The company needs to plan the time of the project in which the company could cover its initial investment and generates profit.

- The scope of the company should stay in the limit of the time constraint and according to the cost that is budgeted in Exhibit 3.

- Highlight the key risks and obstacles that management will have to mitigate for the plan.

- Kids play area is nothing new in the market, there is a possibility that the growth rate will start to decrease sooner than expected.

- As soon as Whole Food will launch this idea in the market, the competitors will also plan something extraordinary to attract the customers back to their own grocery store.

- Identify the triggers or signals that management will use to monitor if these risks are occurring or not.

- The company will keep a track of the growth percentage and will make sure to assess the life cycle stage of the company. They will have to introduce incentives to attract customers if they are unable to meet the growth that they budgeted.

- The company understands the competition it has with other grocery stores and so they have to stay alert and attentive as to what the competitors are doing. In order to stay ahead they have to plan the strategies that they can implement in given situations.

- Rough order of magnitude.

- In order to cater a high level of magnitude we have incurred a 7.5 magnitude which is when multiplied by 10 becomes 75%. This means if all the costs and sales grow by 75% what will be the impact on the business.

In Exhibit 4, all the costs are aligned and shows the costs that will be incurred, the highest expense and profit that a company could generate on a 7.5 magnitude..........

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

Exhibit 1

Exhibit 2

Exhibit 3:

| Budgeting (million) | ||||||

| Initial Investment | 1st Year | 2nd Year | 3rd Year | 4th Year | 5th Year | |

| Estimated Growth % | 20% | 22% | 14% | 10% | ||

| Sales | 2000 | 2400 | 2928 | 3338 | 3672 | |

| Operating cost: | ||||||

| Inventory Handling | 80 | 80 | 80 | 80 | 80 | |

| Utilities | 80 | 80 | 80 | 80 | 80 | |

| Repair Cost | 30 | 30 | 30 | 30 | 30 | |

| Insurance | 60 | 40 | 40 | 40 | 40 | |

| Maintenance | 80 | 80 | 80 | 80 | 80 | |

| Depreciation (15% straight-line) | 90 | 90 | 90 | 90 | 90 | |

| Salaries | 760 | 760 | 760 | 760 | 760 | |

| EBIT | 900 | 1320 | 1848 | 2258 | 2592 | |

| Tax (20%) | 180 | 264 | 370 | 452 | 518 | |

| EAT | 720 | 1056 | 1478 | 1806 | 2073 | |

Exhibit 4:

| Order Of Magnitude (7.5*10) | ||||||

| Budgeting (million) | ||||||

| Initial Investment | 1st Year | 2nd Year | 3rd Year | 4th Year | 5th Year | |

| Estimated Growth % | 35% | 39% | 25% | 18% | ||

| Sales | 3500 | 4200 | 5124 | 5841 | 6425 | |

| Operating cost: | ||||||

| Inventory Handling | 140 | 140 | 140 | 140 | 140 | |

| Utilities | 140 | 140 | 140 | 140 | 140 | |

| Repair Cost | 53 | 53 | 53 | 53 | 53 | |

| Insurance | 105 | 70 | 70 | 70 | 70 | |

| Maintenance | 140 | 140 | 140 | 140 | 140 | |

| Depreciation (15% straight-line) | 158 | 158 | 158 | 158 | 158 | |

| Salaries | 1330 | 1330 | 1330 | 1330 | 1330 | |

| EBIT | 1575 | 2310 | 3234 | 3951 | 4535 | |

| Tax (20%) | 315 | 462 | 647 | 790 | 907 | |

| EAT | 1260 | 1848 | 2587 | 3161 | 3628 | |

| Marketing Cost | 175 | |||||

| Equipment Cost | 1050 | |||||

| Planning and Production Costs | 613 | |||||

| Free Cash Flow | -1838 | 1418 | 2006 | 2745 | 3319 | 3786 |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.