BP AND THE CONSOLIDATION OF THE OIL INDUSTRY Case Study Solution

Problem Diagnosis

This case highlights the dynamics and the transformations that have been taking in the oil and gas industry between 1998 and 2001. The case discusses the rationale of the oil companies for using growth in scale to achieve and enhance profitability and gain the competitive advantage. The strategic implications, pros and cons of vertical integration have also been discussed in this case. During 1998-2001, there was a wave of merger activity in the industry and the chief executive of BP, John Browne was considering the options for growth of BP in future. A s a result of merger activity, the oil companies merged and became super majors leaving behind the small competitors. In this report, we analyze the rationale behind the size of oil companies, vertical integration and recommend strategies for future growth of BP.

First we examine the big size of the oil companies and then examine the rationale behind vertical integration.

Big Size of Oil Companies (Q1)

The size of the oil companies has to be big because of the huge oil demand. The global oil consumption in 2000 was 75.6 million barrels per day and to support such huge demand, a huge supply base is needed. Furthermore, there are distinct operations that are handled by the oil companies such as the upstream segment is responsible for the oil and gas exploration and also developing the reserves. The downstream segment of the oil companies is responsible for the refining of the crude oil that is followed by different processes and marketing. Another important factor is the huge merger activity. These factors suggest the huge size of the oil companies.

Vertical Integration of Oil Companies (Q2)

There are a number of issues faced by the oil companies that are highlighted in the case and these issues support the drivers of vertical integration for the major oil companies. Oil companies should be vertically integrated because of the unstable relationships between them. The amount of sellers and buyers is limited that created bilateral oligopolies thus companies can integrate vertically to reduce the players and behave more rationally. Vertical integration would result in reduction of transportation costs and it can overcome regional restrictions. Control of supply chain would become strong and price discrimination could be applied. Lastly, vertical integration would place big oil companies in stronger position to negotiate with the governments and diversify their portfolios to hedge against the risks.

BP AND THE CONSOLIDATION OF THE OIL INDUSTRY Harvard Case Solution & Analysis

Future Alternatives for BP

There are four alternative available to BP for continued growth which are business diversification, divestiture, internal growth and acquisition. The firm had merged with Amoco so it had experience in acquisition but lack of quality opportunities and competition authorities might prevent growth. Therefore, BP had to consider other alternatives and Browne considered the divestiture alternative.

Conclusion

Based on the industry transformation and challenges faced by oil companies and BP, it is recommended for BP to diversify into a new business and start a new clear energy production business. The company might lose profits from the oil supply as the prices were oil go polistically controlled and the sector has been more like perfect competition. Therefore, BP is recommended to invest in renewable energy sector as the demand for green energy would be increasing in the future years.

Appendix

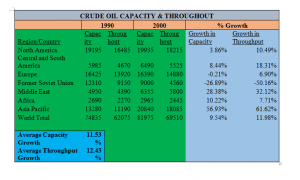

Exhibit 1: Crude Oil Refining Capacity & Throughput