Big Game Case Solution

The general transaction is a global situation as it does not involve a direct investment by LIA in Citigroup shares. On the contrary, only money changes hands, first at the time of the transaction (i.e., when investing $ 100 million) and then at maturity.

Goldman Sachs does not maintain tacit exposure, but covers as much as possible. This is done through over-the-counter transactions with other banks or clearing transactions in the market (including positions in Citigroup shares, Citigroup stock options or more liquid shares linked to shares in the stock index. Citigroup).

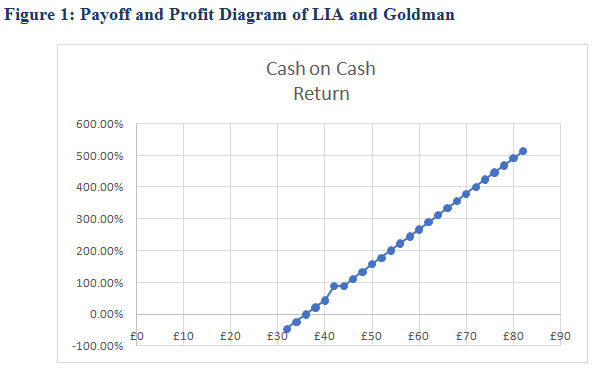

The scenario analysis provided in Exhibit 4 of the case study; the Goldman provided the LIA the payoff according to the basis of indicative internal rate of return (IRR). In this method, an increase in share price will result an increase in the payoff ultimately the cash on cash return and indicative IRR.

Yield of European Options by Using Exhibit 3

Dividend Yield by Using Put Call Parity

| Expiration Date |

Option Symbol |

Type | Strike Price ($) |

Bid ($) |

Ask ($) |

Open Interest |

Underlying price of stock today |

| 17-Jan-09 | VRN.AE | Call | $ 25 | $ 4.70 | $ 4.70 | 39,297 | $ 24.44 |

| VRN.AF | Call | $ 30 | $ 2.60 | $ 2.61 | 87,923 | $ 29.34 | |

| VRN.ME | Put | $ 25 | $ 3.40 | $ 3.45 | 69,211 | $ 24.49 | |

| VRN.MF | Put | $ 30 | $ 6.25 | $ 6.25 | 105,537 | $ 29.33 | |

| 16-Jan-10 | WRV.AE | Call | $ 25 | $ 6.10 | $ 6.40 | 19,821 | $ 24.20 |

| WRV.AF | Call | $ 30 | $ 4.15 | $ 4.45 | 44,015 | $ 28.98 | |

| WRV.ME | Put | $ 25 | $ 4.75 | $ 4.90 | 23,785 | $ 24.05 | |

| WRV.MF | Put | $ 30 | $ 7.55 | $ 7.90 | 49,501 | $ 29.68 |

Cash Dividend by Using Put Call Parity

| Expiration Date |

Option Symbol |

Type | Strike Price ($) |

Bid ($) |

Ask ($) |

Open Interest |

Underlying price of stock today | Dividend Yield | Cash Dollar Dividend |

| 17-Jan-09 | VRN.AE | Call | $ 25 | $ 4.70 | $ 4.70 | 39,297 | $ 24.44 | 2.28% | $ 0.14 |

| VRN.AF | Call | $ 30 | $ 2.60 | $ 2.61 | 87,923 | $ 29.34 | 2.25% | $ 0.16 | |

| VRN.ME | Put | $ 25 | $ 3.40 | $ 3.45 | 69,211 | $ 24.49 | 2.07% | $ 0.13 | |

| VRN.MF | Put | $ 30 | $ 6.25 | $ 6.25 | 105,537 | $ 29.33 | 2.28% | $ 0.17 | |

| 16-Jan-10 | WRV.AE | Call | $ 25 | $ 6.10 | $ 6.40 | 19,821 | $ 24.20 | 1.66% | $ 0.10 |

| WRV.AF | Call | $ 30 | $ 4.15 | $ 4.45 | 44,015 | $ 28.98 | 1.76% | $ 0.13 | |

| WRV.ME | Put | $ 25 | $ 4.75 | $ 4.90 | 23,785 | $ 24.05 | 1.98% | $ 0.12 | |

| WRV.MF | Put | $ 30 | $ 7.55 | $ 7.90 | 49,501 | $ 29.68 | 0.54% | $ 0.04 |

Comparison by Using Dividend Per Share of $0.54

| Expiration Date |

Option Symbol |

Type | Strike Price ($) |

Bid ($) |

Ask ($) |

Open Interest |

Underlying price of stock today | Dividend Yield | Cash Dollar Dividend | Comparison by Using Dividend $0.54 |

| 17-Jan-09 | VRN.AE | Call | $ 25 | $ 4.70 | $ 4.70 | 39,297 | $ 24.44 | 2.28% | $ 0.14 | $ (0.40) |

| VRN.AF | Call | $ 30 | $ 2.60 | $ 2.61 | 87,923 | $ 29.34 | 2.25% | $ 0.16 | $ (0.38) | |

| VRN.ME | Put | $ 25 | $ 3.40 | $ 3.45 | 69,211 | $ 24.49 | 2.07% | $ 0.13 | $ (0.41) | |

| VRN.MF | Put | $ 30 | $ 6.25 | $ 6.25 | 105,537 | $ 29.33 | 2.28% | $ 0.17 | $ (0.37) | |

| 16-Jan-10 | WRV.AE | Call | $ 25 | $ 6.10 | $ 6.40 | 19,821 | $ 24.20 | 1.66% | $ 0.10 | $ (0.44) |

| WRV.AF | Call | $ 30 | $ 4.15 | $ 4.45 | 44,015 | $ 28.98 | 1.76% | $ 0.13 | $ (0.41) | |

| WRV.ME | Put | $ 25 | $ 4.75 | $ 4.90 | 23,785 | $ 24.05 | 1.98% | $ 0.12 | $ (0.42) | |

| WRV.MF | Put | $ 30 | $ 7.55 | $ 7.90 | 49,501 | $ 29.68 | 0.54% | $ 0.04 | $ (0.50) |

LIA or Goldman Arbitrage Profit

By comparing the price of $100 million paid by the LIA for the first Citigroup trade inExhibit 5 to the listed options in Exhibit 3, it has been founded that the deal would create the arbitrage profits because in each deal option, the paying price is lower than the market or even strike price.

LIA Trade with Goldman Rather Than Buying Exchange Traded Options

As soon as the April transaction is executed. There was more talk between LIA and Goldman Sachs about several possible deals. The main agreement discussed was a foreign exchange hedging transaction linked to LIA’s exposure to the USD / EUR exchange rate, as Libya’s income is in US dollars but the disputed transactions outside Citigroup are in euros. Between April and May 2008, there was a lot of email traffic on this topic. Although no coverage was made, the letter related to the competence of the financial team of the inventory team. At the end of May, however, a number of foreign exchange transactions were closed, which were derivatives for an emerging market foreign exchange basket. Another foreign exchange transaction is important because the error in the terms provided by Goldman Sachs caused confusion for the LIA, as it shows how much Mr. Layas understands derivatives.

El Harati also does not remember that Zarti is also worried that Goldman Sachs will be overcharged for including put and call options in the disputed transactions, or the currency chosen in foreign exchange transactions. His only reminder was, "What drives Mustafa crazy is the fact that we don't have a stake in the deal with Goldman Sachs".

All these statements concluded that the LIA trade with Goldman rather than buying exchange traded options or the underlying stocks because it is generating arbitrage profits.

Elephant Trades Fit

In overall, it is recommended that the elephant trade is fit for LIA, so, they should enter into the deal because this deal provides the future profits to the company. As it has identified that the LIA trade with Goldman rather than buying exchange traded options or the underlying stocks because it is generating arbitrage profits which has been concluded by comparing the price of $100 million paid by the LIA for the first Citigroup trade in Exhibit 5 to the listed options in Exhibit 3, it has been founded that the deal would create the arbitrage profits because in each deal option, the paying price is lower than the market or even strike price.......................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.