Bank Of America: Mobile Banking Case Study Solution

Suggesting Actions to The Line Of Business Managers in Short Run on The Basis of Analysis of Various Alternatives

The BofA is currently facing a problem to decide whether to extend its mobile banking or to continue with current practices, and if it decides to go with the option of extending its mobile banking services, then how should it be done? These all decisions would put a great impact on the resources as well as customers of the BofA. Therefore a deep analysis of each alternative including their implications and their pros and cons is required for giving suggestions to line of business managers. A brief analysis of various alternatives is given in the table:

| Alternative 1: To Increase Functionality of Current App | |

| Pros:

· Low capital requirement · Easy to manage · Easy to implement · Low cost |

Cons:

· Increase in complexity of app can provide negative experience to customers by increasing confusion. · Provide less differentiation, as other competitors are using more apps i.e. PNC. |

| Alternative 2: To Develop Customized Apps | |

| Pros:

· Provide competitive differentiation. · High customer satisfaction due to customization. · Low app complexity. |

Cons:

· High capital requirement for building new apps. · High cost. · Can create confusion for customer that which app is for what. · High time required to be implemented. · Risk of high opportunity cost than high opportunity benefit due to high costs. |

|

Alternative 3: To Introduce SMS |

|

| Pros:

· Addressing the 85% of customers with no smartphones. · Low capital requirement as compare to alternative 2. · Easy to build and implement.

|

Cons:

· Completely new channel of mobile banking. · Cost of message given to mobile operator. · Addition of mobile operators as stakeholders. |

| Alternative 4: To Continue With Current Practices | |

| Pros:

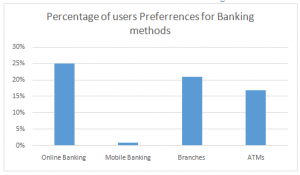

· Avoidance of risk of high opportunity cost than opportunity benefit. · Saving of potential resources. · High user preferences for current method,as shown in Exhibit C.

|

Cons:

· Risk of incompetency and customers switching in long run. · Loss of a cost efficient opportunity. · Risk of market capture by non-banking countries. |

Note:The analysis is based upon the pros and cons of each mobile banking option given in the case study and summarized in Exhibit E.

From the above analysis of various alternatives, it can be analysed that BofA has to extend its mobile banking services in order to compete in the long run. But, it is also true that it cannot implement everything in a short period of time or all of a sudden. Therefore, in the short run, the company should increase the functionality of its current app to the extent where the customers would not get confused. For example; increasing its functionality for only credit cards not the mortgages, as its competitors are providing the services, it would help the bank to compete in the current market with low margin of complexity in its app.However, the company can also go with the option of increasing the number of customized and initiate SMS mobile banking channel after sometime to compete in the long run as well

Exhibits

Exhibit A: Comparison of Mobile Banking of Bank of America with Competitors

| Service/ Media | Bank of America | Citi | Well Fargo | Chase | PNC |

| Mobile banking media | Web browser and App | Web browser and two mobile Apps | Two separate mobile apps | Web browser, App and SMS | Two separate mobile apps |

| Balance check | | | | | |

| Bill Payments | | | | | |

| Transfers | | | | | |

| Locate ATM and Branches | | | | | |

| Credit card balance check | | | | | |

| Payment of credit card bill | | | | | |

| Track credit card rewards | | | | | |

| Credit card due dates | | | | | |

| Corporate customer’s account monitor and control | | | | | |

| Foreign exchange rate | | | | | |

| Virtual Wallet | | | | | |

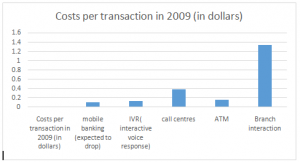

Exhibit B: Cost Analysis of Various Banking Methods

Exhibit C: User’s Preferences for Banking Methods

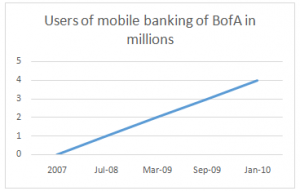

Exhibit D: Adoption Rates for Mobile Banking of BofA

Exhibit E: Analysis of various Mobile Banking Options

| Mobile Banking Options | |

| SMS | |

| Pros:

· Working across all network operators · No software installation requirement

|

Cons:

· Text based; only 140-160 characters per message |

| Mobile Internet | |

| Pros:

· Easiest option as all banks have already online presence

|

Cons:

· Users need a data plan · Browsers speed |

| Mobile App | |

| Pros:

· Apps have potential to engage users · Easy location of branches and ATMs · High growth in smart phone use.

|

Cons:

· High cost i.e. Simple $40000-50000 while complex app can cost several hundred thousands |

Exhibit F: Analysis Mobile Payments Market via Non-Banking Channel

| Mobile Payments Market Via Non-Banking Channel | |

| Modes

|

Threats |

| Local mobile payments

|

It includes payment to merchant via mobile phone. This method can substitute credit or debit cards. The technology is in its early growth in US in 2009, with expected rapid growth.

|

| Mobile commerce

|

It also includes payment to merchant via mobile phone. Here the customer is required his/her mobile number instead of credit card number, the payment is made by the subscriber i.e. Zong at point of purchase and then it is included in the mobile bill with a 30-50% margin. This method eliminate the use of credit cards.

|

| Person to person payments

|

It includes various activities like transfer of money, purchases, and payments of bills through various means including credit and debit cards. These activities are done through non-banking channels i.e. PayPal.

|

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.