Angus Cartwright Case Study Solution

John Deright and Judy Deright both intend to diversify their investments. To achieve their desired purpose which is diversification of risk they intend to invest in real estate but for a short period so that they can increase the future value of their investment. Four properties have been considered by them on which they can invest but the critical factor of investment will be growth in the future value of the property.

Derights intend to sell the properties in future therefore evaluation criteria at the time of purchase is essential.

Derights do not have any experience in the real estate they don’t know on what criteria they should evaluate these properties to tackle these problem they consult with Angus Cartwright. Therefore, it is necessary for Cartwright to evaluate all four properties at the time of purchase. So that he can advise Derights about the future worth of the properties. The four properties under the consideration are Alison Green, 900 Stony Walk, Ivy Terrace and The Flower Building.

I have taken two properties of 900 Stony Walk and Flower building based on the loan to value ratio. The900 Stony Walk has the loan to value ratio of 82% while the Flower building has the loan to value a ratio of 76%. These both properties also have higher tax return as compared to other two properties.

Analysis of 900 stony walk

The property 900 Stony Walk has an after tax return of 84.65%, it has the second highest after tax return among the four properties.It has been identified that interest rate would be increasing at 6.5% but decreasing in the amortization period to 25 years. The property will generate second highest after cash flows.The net present value of this property is 7.530 million dollars with the purchase price of 15 million dollars and sale price of 17 million dollars. Deright family can earn the profit of 2 million dollars, when they sell this property after purchasing this property.

Angus Cartwright Harvard Case Solution & Analysis

Moreover, the tax benefits would be achieved at 13.37% at the selling time. As a result, the future value of 900 Stony Walk, that would be better than Alison Green. Consequently, the internal rate of return would be generated at a higher rate that would allow investors to make purchases. Therefore, it would somehow be considerable as a right option for Deright to consider about the respective property with high capital gains on selling.

Analysis of Flower Building

The second property Flower Building has an interest rate of 7.5% which is the highest one and term of loan would be 10 years. Furthermore, investors are willing to invest in this property. The property Flower Building has an after tax return of 90.42%, it has the highest after tax return among the four properties.It has been identified that interest rate would be increasing at 7.5% but decreasing in the amortization period to 25 years. The property will generate highest after cash flows. The net present value of this property is 18.219 million dollars with the purchase price of 27.5 million dollars and sale price of 34.5 million dollars. Deright family can earn the profit of 7 million dollars, when they sell this property after purchasing this property.

Therefore, it would somehow be considerable as a right option for Deright to consider about the respective property with high capital gains on selling.

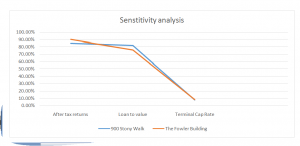

Sensitivity analysis

Above graph was generated based on the data of after tax returns, loan to value ratio and term cap rate.

Above graph shows that 900 Stony Walk has the after tax return of 84.65% with loan to value ratio of 82%. This property has the terminal cap rate of 7.58%.

Moreover, Flower Building has the after tax return of 90.42% with the loan to value ratio of 76%. This property has the terminal cap rate of 8.31%.

Recommendation

From considering the valuations and situations behind the properties, it is estimated that the purchase will be financed through debt while the debt percentage for each property is different. Furthermore, the decision to invest in this industry depends over many factors like capitalization rate on sales, after tax returns, net present value and others. If we consider all these for the above properties, then we cannot reach on any decision like on which property we should invest because some are worst in some areas but are best in others. But if we take an average of all these, then we can say that Flower building is the most suitable property as it has the highest after tax return of 90.42%, with the highest term capitalization rate of 8.31%. On the other hand, the NPV and IRR of Flower building is much better than any other property.

From above analysis, we would recommend DeRights family to purchase the flower building property................

This is just a sample partial work. Please place the order on the website to get your own originally done case solution.