Aqua Bounty Case Study Analysis

Situational Analysis

The company’s Valuation

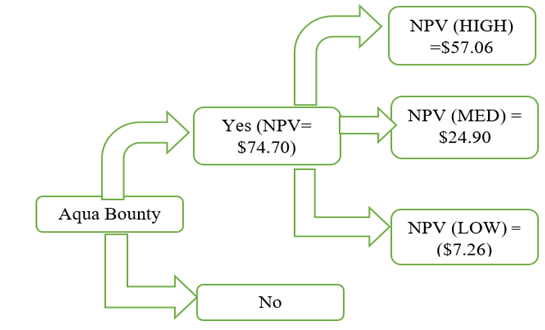

For the valuation of the company, we have used the following probability tree.To make it we have identified the NPV for AquAdvantage revenue projections considering all scenariosi.e. at High, Medium, and low. We have assumed the discount rate to be at 10% for the company. Based on these assumptions the NPV of the firm is identified as 57.06 million dollars in case of the High scenario, 24.90 million dollars in case of the medium scenario, and (7.26) million dollars in case of the low scenario. Using the weights for each probability as 33.33% the weighted average NPV is determined to be 74.70 million dollars. Lastly by using the outstanding shares of the year 2005 the IPO value per share for the company is identified to be dollar 6.00 per share.

Note: Refer to the Exhibit for Calculation

Probability Tree

Recommendation

Based on the quantitative analysis the 6.00dollars per share value for the IPO of the company is suggested with the approval of the FDA. The identified per share value seems to be reasonable for the company as the initial price of the company’s comparable company named is8.35 dollarsper share. Hence the company must go with this value for its IPO process.

Aqua Bounty Case Study Analysis

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.