HIGHLAND MALT ACCOUNTING POLICY CHOICES IN FINANCIAL STATEMENTS

Key Assumptions

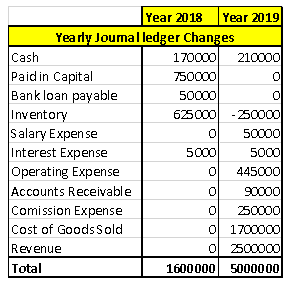

We have created the following assumption of this case, which is based upon receipt of cash payment to the sponsors. All accounts of Highland Malt are considered as accounts receivables. This account is due on a sale. The first in First out method, which is used to record the sales and cost of the goods sold. In the first year of 2018, there wasn’t any chargefor rent expenses. This organization is located in Scotland, whose entire transactions are recorded in the US dollars.

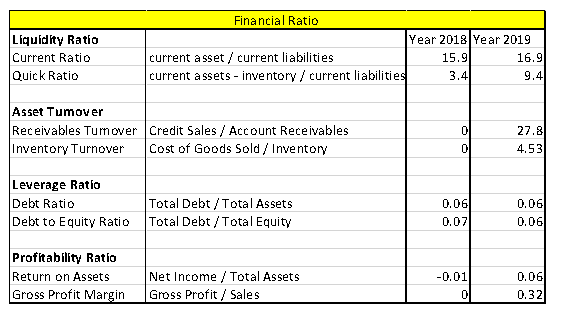

Analysis the Company through Financial Ratio

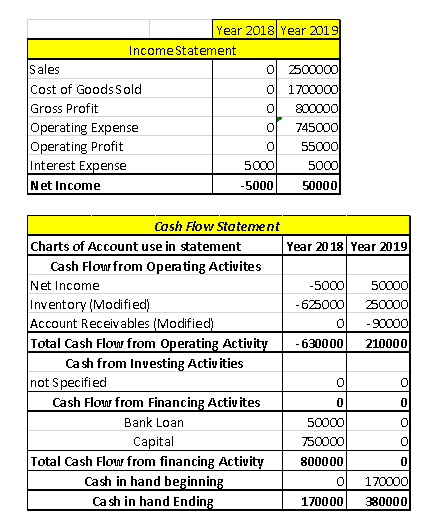

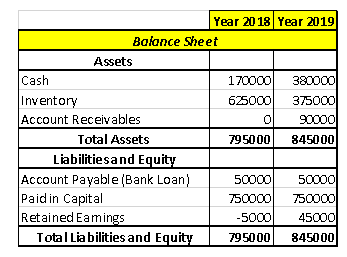

According to our analysis of the organization; we have determined that the current ratio is 15.9 in 2018 and 16.9 in 2019. The quick ratio of the organization is 3.4 in 2018 and 9.4 in 2019. The debt-equity ratio is 0.07 in 2018 and 0.06 in 2019, which is mostly the amount invested through the shareholder’s equity. The debt ratio is 0.06 in both of the years. The ratio of inventory turnover is 4.53 in 2019. The ROA is 0.06 in 2019 and if this figure is rounded, it would be close to 0.1.

Recommendation

According to the financial ratios & examination of the financial statements; Highland Malt is a very less profitable organization. The return on assets is very less and the overall time to make and continue the barrels is very much lesser, which makes it ales-profit generating organization. In order to increase its profitability; there must be modifications to the agreement with the commission on Spencer's to permit for recovery of the commission in order to have profit as that sale is no longer included into the bottom line. The net income of the organization is low and its return on assets is lower than its manufacture cost & there are high barrels of the timeline.

Selling bottles individually would result in the net profit of $ 500 per barrel or another 125,000, based on the $65 per bottle of 250 barrel volume sold over the period of two years. The debt to equity ratio makes the organization seem very attractive to make an investment in, but there could be misleading figures in the statement. There is an agreement on the instability in estimating the mature barrels o mature & their accessibility which manages the high manufacture cost and lower profits. The ROA and ROE are 0.06. This is a very less return on the investment, but the market is continuing the growth face.

Appendices

All calculations are done in a excel file, excel is attached.

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.