Machinery International Case Study Analysis

Machinery International (B)

Why would Machinery International enter into the forward exchange contract?

Machinery International would enterinto the forward exchange contract to reduce the translation risk or exposure of the royalty payments that it usually receives from its foreign subsidiaries which are dominated in the functional currency. By using the foreign exchange contract, the company would be able to hedge the exposure and reduce the risk and uncertainties that are related with adverse movements in the exchange rate. In addition to this, if the exchange rate would move against the Machinery International, the company be better off overall and save money & the potential of a headache when transferring large amounts. Additionally, the company would not be obliged to pay for the transfer until the maturity of the forward contract.

Undoubtedly, the forward contract would be beneficial for the company to deal with the risk of exchangerate fluctuation. It would help the company in fixing the future rate, hence reducing the exposureof downside risk. The forward contract strategy provides a complete hedge and is flexible withregard to the amount be covered.All of these benefits provide the solid foundation of adopting a forward contract hedgingstrategy to mitigate the foreign currency risk.

Is the forward exchange contract a derivative?

The forward exchange contract enables company for foreign transaction execution at a designated rate of exchange agreed with a banking institution, which would secure the fund’s realization as well as omits any inevitable circumstance and uncertainty relayed with foreign investment.The company couldearn more profits with hedging. It is acustomizable derivative contract used by organization, whose primaryobjective is to limit their risk & exposure to the volatility in the exchange rate.In addition to this, the forward exchange derivative contract are widely used for the purpose of hedging or speculation against the possible changes in the market factors in the near future and hence against the underlying asset’s market value in the future.

Is Taylor’s assessment that the forward exchange contract qualified for cash flow hedge accounting correct?

Cash flow hedging accounting is used in order to reduce the impact on the cash flow due to variability in the exchange rate. The company enters into the contract and hedge against the potential loss in value of cash flows generated in future ahead. The hedging assessment of Taylor’s that the forward contract qualified for the cash flow hedging is correct because it would give gain to the company in future, and its suits best to the transaction rather than entering into another hedging, such as: foreign currency riskhedge and fair value hedge.

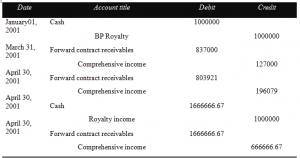

What are the journal entries in the parent’s book (all assume in US $) on January 1, March 31 and April 30, 2001 associated with the illustrative example described in Exhibit 1?

Referring to the Exhibit 01 in the case, the journal entries in the parent’s book (all assume in US $) on January 1, March 31 and April 30, 2001 are as follows:

............................

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.