Universal Car Rental Case Study Solution

Pricing to Target the Particular Customer Group:

Yes, I will definitely to target the particular customer group, for which I need to set the specific pricing technique which must relate to the pricing of the product. In order to target any specific group such as business group of the company, the high prices will reflect the more premium product which is irreplaceable from any other rental car brand. Business consumer group is not a seasonal customer group and to target them will assure the company about their future consecutive profits.

Competitor’s Pricing Strategy:

It had observed that the competitor’s prices around $5 lower than the Universal Rental Car pricing which indicates that the competitor is following the lower pricing strategy in order to capture more market share as compared to the Universal Rental Car. By maintaining the $5 difference in prices, if Universal Rental Car increasing $1 in his prices, competitor is also increasing $1 in his prices.

Competitor’s Pricing Strategy Analysis:

In response to pricing strategy of Universal Rental Car, the competitor is not responding intelligently because by analyzing the competitor’s income statement pertaining to September is showing the total accumulated profit for Orlando around 1.84 million dollars and the total accumulated profit for Miami around 0.888 million dollars which is lower than the total accumulated profit of Universal Rental Car in Orlando and Miami.

| COMPETITOR INCOME STATEMENT FOR: SEPTEMBER | ||||||

| Orlando | Miami | Florida | ||||

| Total | Per Car | Total | Per Car | Total | Per Car | |

| Revenue from weekday | $17.6 M | $40.00 | $10.5 M | $45.00 | $28.1 M | $41.74 |

| Revenue from weekend | $6.74 M | $37.00 | $1.76 M | $39.00 | $8.49 M | $37.40 |

| Total Revenue | $24.3 M | $39.12 | $12.3 M | $44.03 | $36.6 M | $40.64 |

| Variable costs | $9.95 M | $16.00 | $4.74 M | $17.00 | $14.7 M | $16.31 |

| Vehicle inventory costs | $7.25 M | $11.66 | $3.64 M | $13.07 | $10.9 M | $12.09 |

| Fixed costs | $5.29 M | $8.51 | $3.00 M | $10.77 | $8.30 M | $9.21 |

| Pre-Tax Profit | $1.84 M | $2.96 | $888 K | $3.19 | $2.73 M | $3.03 |

Global Market Condition:

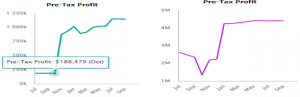

The demand is moving in a straight way which could be seen in the below mentioned pictures.

In short, it was a good year to be managing the business because by observing the profits of last quarter of previous year which are shown in below mentioned graph, it has found that the total profits from two segment such as Miami and Orlando are increased with the total growth in profits of around 516% and 69% respectively.

These premium pricing strategy would not be beneficial in long term and need to be changed in future because our capacity utilization rate is 85% and in future if demand will increase, the high premium prices would not be a good option for the company because company would go for the 100% utilization of its current capacity which would only be successful if the prices would go down by its current position.

Conclusion:

It has been concluded that the total profits from two segment such as Miami and Orlando are increased with the total growth in profits of around 516% and 69% respectively by applying the premium pricing strategy on Universal Rental Car. In response to pricing strategy of Universal Rental Car, the competitor is not responding intelligently because its total accumulated profit for Orlando segment is around 1.84 million dollars and the total accumulated profit for Miami segment is around 0.888 million dollars, which is lower than the total accumulated profit of Universal Rental Car in Orlando and Miami due to its price skimming strategy……….

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here