Eli Lilly In India Case Study Solution

Alternative – Termination of Joint Venture

Pros:

- Large number of opportunities are offered and is mature enough to operate in Indian pharmaceutical industry.

- Existence of successful ELR in India providing Lilly with great interest to make decisions with complete control over operations.

- Full control and technology integration and subsidiary know how in realization of organizational strategy.

Cons:

- It is expected for generation of huge financial commitments.

- Requirement of high investment in establishment of own channels of supply and distribution.

Recommendation:

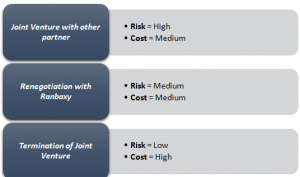

Considering the fact of both organizations and pharmaceutical industry, as per short-term strategy, Lilly should renegotiate with Ranbaxy as it had medium risk to be failed and medium cost required on the basis of pros and cons of the alternative. If as a short term strategy, this plan does not give potential outcome, then Lily should go towards termination of joint venture. With the fact, there are low legal policies and regulations after India became member of WTO. This is expected that as a result in coming three to five years, Lilly as an individual organization will flourish more rapidly in an effective manner as its R&D is also strong with high capability of performing clinical trials.

Action Plan:

Negotiation with Ranbaxy in terms of transfer of shares:

Positive development of existing relation for encouragement of Ranbaxy for share transfer to Lilly. Discussion over significant incentives and concessions for purchasing of shares at set interval end.

Future Evaluation of ELR:

Assessment of partner’s need which may either be permanent or temporary. Similarly, determination of operation’s outcome which involves generic vs patents, drug production and distribution, clinical trials and Research and Development. Evaluation to capability for production and distribution of products independently.

Integration Ranbaxy in Value Chain of Eli Lilly:

Promotion of good relation and operating conditions i.e. favourable with cooperation, honesty and nurture trust.Establishment of strong linkages among headquarters and subsidiary for structure institution of global learning.

Outsource Manufacturing:

Negotiation of Lilly with Ranbaxy for outsourcing contract for production and product distribution considering length of contract, responsibilities and outcome.

Development of own Capabilities:

It involves evaluation of ability for establishment of own capabilities including pros of outsource manufacturing and cost.

Conclusion:

The recommendation of the strategy will help Lilly to retain its foothold in India. Simultaneously, it will also enable the organization to take benefit of existing positive and potential developments in market. The organization will then have the ability to meet the sales target at international level. In addition, maximum returns will be obtained with increase in profitability.

Exhibits:

Exhibit – SWOT Analysis

| Strength | Weakness |

| · Twelfth largest organization

· Managerial excellence with leading brands · Capabilities of R&D · Capabilities in clinical trials |

· Infringement and expiration of patents

· Lack of focus on product expansion · Reliance on international sales |

| Opportunities | Threats |

| · Increased demand of pharmaceutical products

· Population for clinical trials · Positive changes in India’s business environment |

· Evolution in structure of competition

· Significant increase in operational costs · Weak protection of intellectual property rights |

Exhibit – Porter’s Five Forces Analysis

Exhibit – Alternatives with possible risk and cost

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.