The offshore oil drilling Case Study Solution

The offshore oil drilling and exploration business is a highly volatile business demanding long-term commitment where the players face internal and external challenges for securing financial gains which are subject to fluctuations.

Critical Issues:The attractiveness of offshore exploration is linked to oil prices and which can fluctuate due to various external factors. For instance, rising demand for oil may trigger rise in prices and could increase entry of rig manufacturing firms. However, excess supply leading to under utilization of rigs will eventually lead to lower financial returns for these contractors.Oil prices are rather volatile too and factors like excess supply from a region like Iraq could bring the price down.External factors like recession or warmer weather conditions could also bring prices down. These factors would in turn affect the revenues and profitability of operators and contractors engaged in the process of drilling.Cartels formed by global oil producers such as the 11 OPEC countries that control 75% of the world’s oil reserves also affect oil prices since these countries have a monopoly in the form of 40% of the oil production in their region. Changes in GDP, weather fluctuations, increasing transportation and consumption needs of emerging markets are some of the other factors affecting oil prices in the economy.

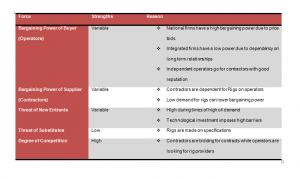

Analysis of the off shore Oil Drilling & Exploration Industry:The industry would be studied using Porter’s five forces Analysis for the two main players in the industry, the contractors and the operators. The contractors in an oil drilling and exploration industry have a high bargaining power in the industry especially as they provide the rigs used for exploration in this business. Even the largest of oil companies may only be able to have a few rigs of their own. During times of low demands for oil, the rigs would be in low demand too, leading to a low bargaining power of the seller or the rig contractors. The threat of entry in the oil and drilling industry can be high in times of a high demand for oil and firms may be more willing to invest in rigs. However, these expenses are in the form of a long term commitment to a project and so massive technological infrastructure offers a substantial degree of barriers to entry for small operators. The bargaining power of the operators in the industry varies depending on the type of contracts. National firms select bids on a price basis and have a high bargaining power. A reputation raises the bargaining power of independent contractors in front of operators and integrated operators would have a low bargaining power when working with a contractor they have a long term relationship with. In markets where rigs were available, the contractor would bear the cost of relocation where as in areas of few available rigs the operator has to bear the cost. So the bargaining power of the contractor is also variable.

The offshore oil drilling Harvard Case Solution & Analysis

The threat of substitutes to rigs in the oil drilling and exploration industry are low since this equipment is rather standardized in terms of its specifications. However, different categories of rigs are there depending on the type of exploration under way. The industry offers a high degree of competition simply because the industry has high volatility and securing contracts can be tough in a market where each contractor is looking for long term financial gain.

Conclusion: The oil drilling and exploration business may have high risks because of the high volatility of oil prices but this industry offers substantial returns in the form of large revenues even to small firms which can make up to $10 to $20 million.Larger firms in this industry are of course better off financially as they can aim for revenues as high as $10 to $15 billion

This is just a sample partial work. Please place the order on the website to get your own originally done case solution.